Basic-Fit ($BFIT, €37.6): Shared Scale Economics Compounder

10-July-2022

Recommendation: Buy BFIT with a DCF long-term target price of €75.4/share (+100% upside).

Key Points:

Differentiated Offering in a Commodity-like Business: cheap prices and convenience are the only key decision drivers behind gym selection. BFIT is best-in-class in both.

Shared Scales Economics: Moat revolves around the fact that as BFIT gains scale, it gives back savings to customers by keeping its prices constant despite inflation. Smaller competitors do not have this luxury and are underpriced.

Local Monopolies: High gym densities lead to monopolistic behaviours since if the densities are high enough, it makes no sense for competitors to enter the market. The unpenetrated customer base is simply too small. This is further enhanced by the fact that BFIT users can go to any gym. Therefore, the massive investment needed to offer a similar level of service is the barrier to entry. This is essentially DPZ’s fortressing strategy but for gyms.

No Large Competitors: Competition is fragmented across Europe with a few local champions. BFIT is the only European operator that has managed to reach a true multi-national scale. This has enabled them to “invade” new countries by underpricing competition with the cash generated in their current locations.

Execution Excellence: one of their core strengths is execution. This was shown by the French expansion over the last 5 years where they have become the dominant player by almost starting from scratch.

Outstanding management: Rene Moos, CEO and founder, still owns 14% of shares. He is clearly exceptional and has been able to create a robust team.

Valuation: High investments in new gyms hide how much cash the company should be able to produce. On my numbers, BFIT currently trades at c. 4.4x 2026 normalised FCFE

Risks:

Execution! This is clearly the largest possible source of problems. Given the low valuation, market is discounting their chances of success / implies new gyms will be value destructive

New covid related lockdowns / measures

If post-covid consumer trends go against gyms leading to lower club unit economics. If less people go to gyms post-covid, their clubs will make less money due to the proportion of fixed costs. Given that most of club demographic is focused on 18–35 year-olds, the covid impact should be negligible.

Inflation in gym equipment prices impairs unit economics

Planet Fitness expansion in Europe

Conclusion: BFIT is a high-growth company that shares scale-related benefits with its customers by keeping its prices constant despite inflation. Combined with the lack of any large competitors and the defensiveness of its business model, it is the Gorilla (see Geoffrey Moore) of its industry. Execution is their major risk but their track record is enough to build confidence in the future. To sum-up, BFIT is a simple business with a reasonable valuation which is why I find it particularly attractive.

Introduction: History of BFIT, a management we trust and admire

In 2004, former professional Dutch tennis players Rene Moos and Eric Wilborts merged their tennis and mid-market fitness centers into a single company called HealthCity. Its clubs would charge 50-100€ on average in line with the market. Through acquisitions and new club openings, they managed to grow from 12 to 100 clubs in 3 years, focusing on the Netherlands, Belgium and Germany. Funding was provided by the Dutch PE fund Waterland which acquired a 30% stake and later in 2006 increased its stake to 50%. Rene explained that scale was the main driver behind this growth. At the time, larger chains (Fitness First and Achmea) were expanding quickly and HealthCity would be pushed out of the market if they did not grow. Until then, the company was run with no debt and was cash flow positive. One of the deciding factors was the leverage gained on equipment makers as you become larger. Smaller clubs would have had a hard time. The original plan for the PE investor was to grow to 100 clubs and then exit but the team got along well with Rene and stayed invested. Their motto to “run the club as if it will never be sold, keep investing where necessary” resonated well with the HealthCity management.

In 2011, HealthCity acquired Basic-fit, a low-cost operator with 32 locations in Holland. The idea to expand into low-cost came from Planet Fitness, the large US low-cost gym operator with an impressive growth record. In 2012, most of the HealthCity clubs were converted into Basic-Fit. This caused a row with Waterland which was uncomfortable with the new strategy. Rene and Eric took a bank loan and bought the Waterland stake. In 2013, 3i invested €110m into Basic-Fit at an EV of €275m. Basic-fit was now a separate entity from HealthCity, operated 200 gyms and Eric was no longer involved in the management.

The company filled for IPO in May-16, raising €370m of primary capital. 3i and Eric Wilborts sold a stake of €30m. The IPO came at the low end of the range at €15/share. Eric sold his 6% stake in Jun-18 at €26.75 / share. Rene still owns c. 14% of the company and has not sold any shares, he participated in the 2 covid related capital raises which diluted him from a 16% stake. 3i have been selling shares over the last few years:

1. Attractive Market…

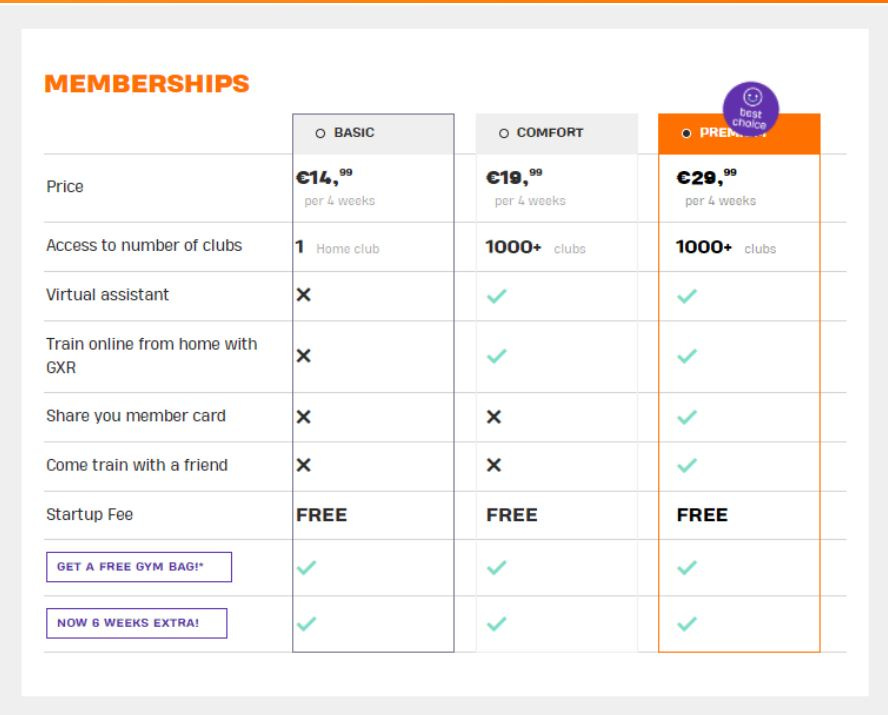

BFIT is the largest gym operator in Europe with more than 1k gyms and 2.2m members (Dec-21). Its core offering consists of a €19.99 membership per 4 weeks which is much cheaper than the €40/month offered by average gym in its competing markets (see below).

A key part of BFIT’s value proposition is that customers can then use their membership in any club of their choice (some are open 24/7). In practice, it means a whole family can use a single membership if they don’t go at the same time. Churn is essentially reduced due to the low prices and flexibility, even the cancelling process is straightforward as up to 50% of new members of mature clubs are re-joiners. In 2019, an average member kept his membership for 22-23 months vs 18-19 months at the IPO.

Much like discount airlines, BFIT has both gained significant market share and grown the overall pie. By reducing friction and costs usually associated to fitness clubs, BFIT has made it possible for members who would not have become gym members otherwise to join. This is not something unique to BFIT, the UK and the US where discount operators are more present tell a similar story. Over the last decade, the vast majority of new gym members were in the low-cost segment: 90% in the US and 67% in the UK. Even crazier, Planet Fitness membership increase was equivalent to 86% of new gym members in the US which is clearly a sign of monopolistic behaviour. This is quite unusual for the gym industry where the product sold is a commodity with little differentiation. More on this later.

Another important trend is that fitness membership penetration is much lower in Europe than the US (see below). This trend is evolving as habit and generations change, currently, just 10% of Basic-Fit customers in France are over 50 and the largest group is the 18-35 age group. In other words, going forward demographics will also drive their growth.

2. …Full of White Space for Expansion

BFIT is the largest gym operator in Europe, the growth in the number of clubs has been spectacular (see below). In 7 years, it built the largest gym operators in France starting from scratch.

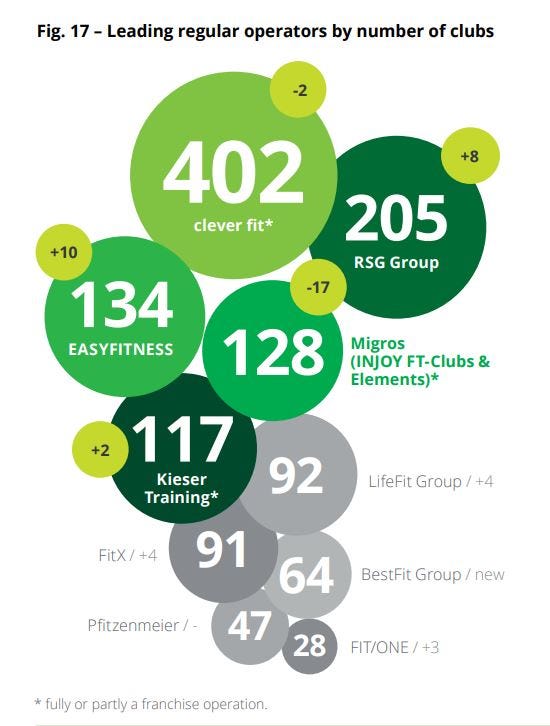

We can see below the competitive landscape in 2017 and 2021. The UK low-cost names have also been quite active aggressive in ramping up their gyms. There is no competitor with more than 1000 gyms in Europe. Given BFIT plans to build another 1000 gyms in the next 4 years, the gap will only increase.

2017:

2021:

Competitors in each country:

The Netherlands and Belgium are BFIT’s traditional markets. It is by far the largest player in Belgium with 60% of the market share. In the Netherlands, the market is less consolidated but BFIT is still the main player since its market share is c. 20% which is twice as much as its closest competitor. The long-term plan is to reach 300 gyms in each country and they have been growing clubs steadily. There are also 10 clubs in Luxembourg, but this is a saturated market. The clubs in these markets have essentially provided the funding necessary for the French expansion.

Basic-Fit strong execution in France was not a given at the start. But BFIT took the time to do things right. First, the person who led the very successful expansion in Belgium was also leading the expansion in France. Secondly, they waited to understand the market and the differences in culture before increasing the number of gym openings. French landlords took advantage of them on the first leases as BFIT lacked negotiating experience on the specificities of the French RE market. Once the learning period (3 year) was over, execution has been tremendous and they have opened c. 100 stores p.a. in France over the last 5 years. The French opportunity relied on the fact that fitness penetration in France was low and therefore there was less interest on this smaller market. BFIT were confident that they could increase the penetration rate by lowering prices. French competitors are more expensive but they have tried to fight against BFIT. For example, before a new BFIT opens, it is quite common for nearby gyms to start offering cheap 2 year memberships to lock-up customers. France will be the major source of growth in the next 5 years with 100-150 news stores p.a. The end goal is to reach 1000-1300 clubs in France. After that, the French clubs will provide stable cash flow to re-invest elsewhere in Europe.

Spain is the next immediate opportunity. BFIT’s strategy is to mainly focus on a single country when expanding. That is why from 2015-2019, only 10 BFITs were open. The team was simply busy with the French expansion. Now that they have gained meaningful size in France, the goal is to ramp up Spain. The other decisive factor was that competition was hit by covid and does not plan to expand which has created an opportunity to go on the offensive. The plan is to reach 100 gyms by Dec-22 compared to 36 in Dec-19. The long-term plan is to build at least 450-650 BFITs in Spain. At the IPO, they were even plans for up to 800 stores in Spain.

Despite covid and the need to have 2 equity raises, BFIT has not cut down on investments and actually announced even more upbeat targets. They plan to double their installed base in 5 years to reach 2000 gyms by 2025 and reach 3000 gyms by 2030. They don’t need to enter a new market to achieve their 2025 goals but in Mar-22 they announced that they would.

Germany is the largest market in Europe and despite BFIT’s successful track record at expanding in France, there are no guarantees for success. The market is appealing since it is reasonably well fragmented and the 2 largest players have not grown massively since 2017. As for France, BFIT will enter the market slowly with 20 gyms planned by Dec-22 and then 60 by Dec-23. The idea is to learn the intricacies of the German RE market so they are ready to scale their expansion once they reach maximum size in France and Spain. Germany is clearly an expansion story post 2025.

Basic-Fit’s ancestor HealthCity had a few gyms in Germany. Therefore, it is not crazy to think that BFIT’s competent management knows the market and that is why they previously decided to invest in France rather than Germany. They preferred to have a strong base of gyms elsewhere to provide the funding before expanding in Germany. Discounters are certainly not a new concept in Germany, so we should assume their gym market is also more competitive.

Largest players in Germany (2021):

Given the already high penetration of gym members and even higher penetration of low-cost gyms, the UK is not a priority for BFIT. There are simply better opportunities in Continental Europe and it would not make any sense to allocate capital in the crowded UK market. The only reason to enter the UK would be if their re-investment opportunities diminish. Their current plan is to keep building new gyms until 2030 so this is a non-issue for now.

Gym-pass aggregators such as Gympass and Classpass are an interesting trend but they have been hit hard by covid and are not a threat to BFIT in their current form.

3. Defensive strategy resulting in almost monopolistic behaviour

One of the key aspects of BFIT is their “Cluster” strategy. The goal is to create a network of clubs in a town in order to increase customer convenience and most importantly avoid leaving breathing space for the competition. It makes littles sense to choose a smaller competitor if a BFIT subscription gives you access in clubs close to work, home, etc. Some of the clubs might be less profitable at first as they self-cannibalise but in the long run the brand is more entrenched. This is not specific to gyms, Domino’s Pizza’s “Fortressing” strategy or the roll-up strategies in pest control are similar.

The reason behind this strategy is clear, gyms are a pure commodity only differentiated by price and convenience, much like Domino’s. Therefore, the only way to create a barrier to entry is to create a dense network of clubs that leaves little economics for other clubs. Essentially, this is a local monopoly. BFIT usually targets to have c. 30k inhabitants / club to achieve a 11% penetration rate. But the clustering strategy means it might build more clubs to dominate the market.

BFIT’s size and brand name helps them serve as an anchor tenant and attract footfall. That is clearly valuable for landlords who are therefore willing to give better terms or locations to BFIT. Smaller gyms are riskier and will not have the same terms.

See below for Clermont-Ferrand, a 140k habitants city in the center of France. Given there are 6 BFIT clubs, it makes its quite hard for any other chain to enter Clermont. A competitor would need to open 6 gyms, otherwise BFIT will always be closer to its customers. Given BFIT is also one of the cheapest options, competing on price and number of locations is clearly not attractive for new competitors. Therefore, high densities are a form of barrier-to-entry in an otherwise commoditised environment.

4. Business Model with High Operating Leverage

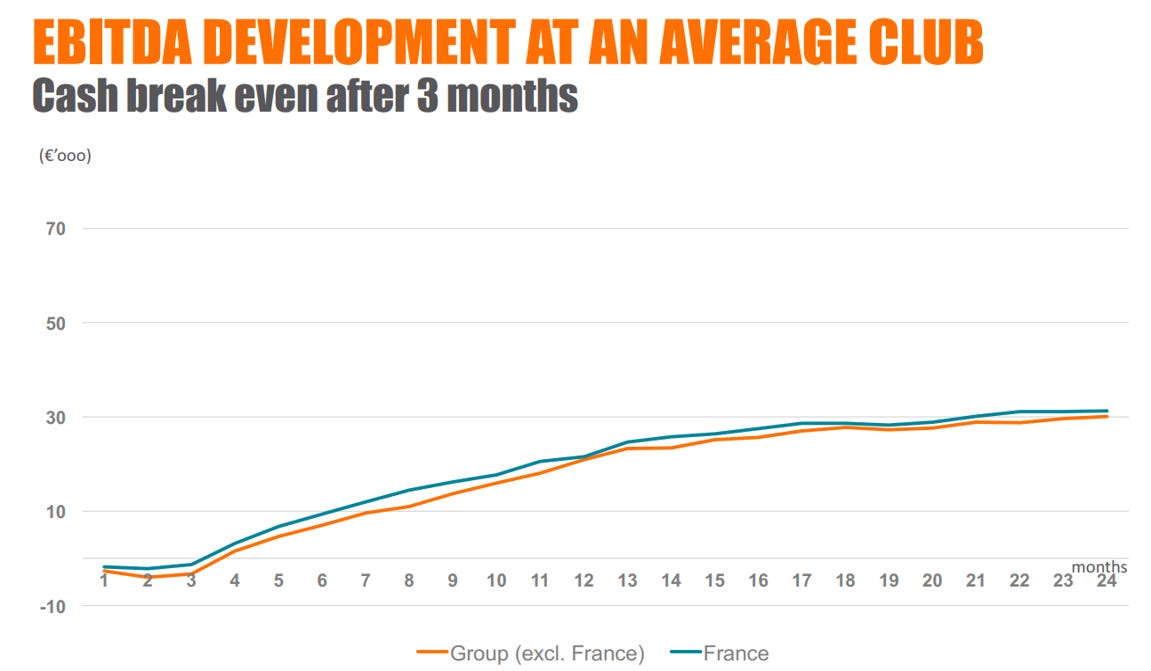

Before a Basic-fit is opened, a local manager is hired to pre-promote the club. The goal is to have at least 1k members at the opening. Once it reaches 1600-1700 members, a club is at breakeven on an EBITDA level which usually happens 3m after the opening. It takes 24m to reach the point where a club is considered to be “mature” which usually means it has c. 3.3k members. For mature clubs, the breakeven point is at c. €10/m per user which means that BFIT can survive price wars as the usual breakeven price for competitors is at c. €30/m.

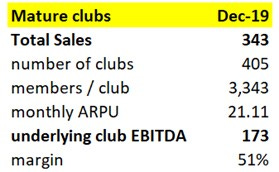

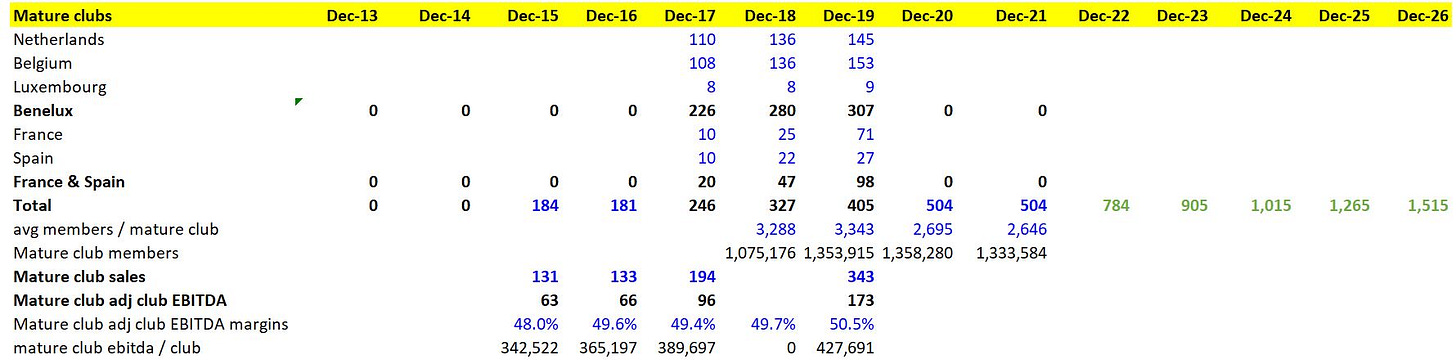

From 2015-19, the 30 oldest clubs (mainly Netherlands and Belgium) have averaged 3300-3400 members giving us confidence they reach the targeted matured state after some time. At this point, a BFIT gym is essentially an infrastructure asset.

In a mature state, the EBITDA stabilises at c. €30k/m (see below). Note that France is particularly profitable as they have more members / club than other geographies. However, VAT stands at 20% vs 6% and 9% in Netherlands and Belgium which is a clear drag since the membership stays at €19.99. This results in similar economics despite the higher members / club.

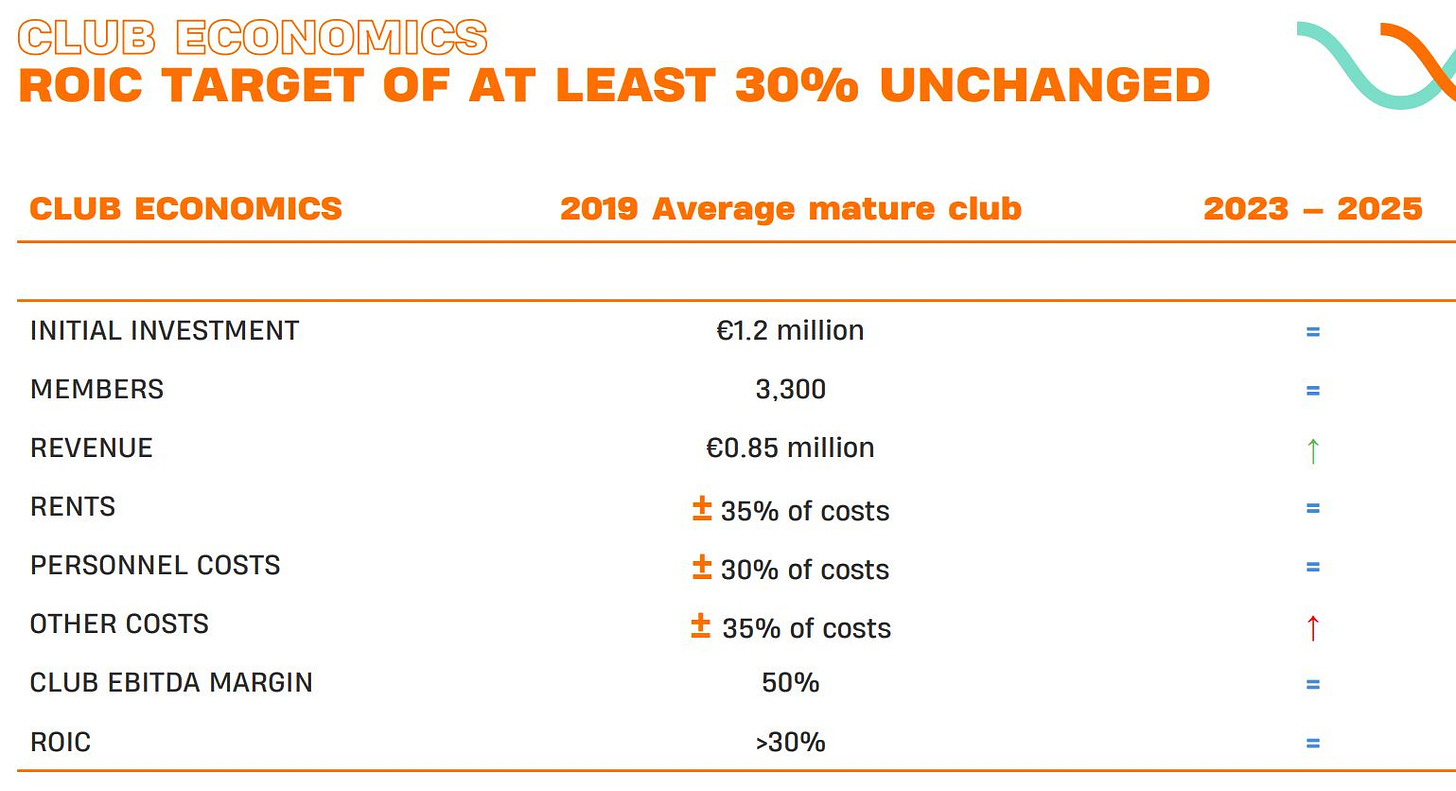

Creating a new Basic-Fit requires a c. €1.1-1.2m investment:

Cardio and strength equipment combined equals 25% of the build-out cost and are replaced in year 4-5 and 10.

40% of costs are related to the internal fit-out (walls, cables, partitions, etc.).

And finally, 35% is invested into TVs, sound systems, HVAC, showers, etc. The replacement of those final assets is mostly charged as operating costs.

They lease properties for c. 10 years and never own the walls.

It is also worth noting that most of the capex items have a longer useful life than their depreciation charge implies. An interesting point from the 2016 IPO is that the auditors forced them to increase the depreciation period for gym equipment from 5-6 years to 6-8 years and therefore decreasing the depreciation charge (see appendix). It must have raised some eyebrows at the time.

Combining those factors, we can infer that the total depreciation charge per club is higher than the maintenance capex required to keep each club up-to-date in a matured state. Management estimates that the normalised capex / club is c. €70k vs €55k currently since most clubs are newly built. Comparing it to the average depreciation charge per club of c. €120-125k, this is favourable for margins going forward.

Let’s look at the pre-pandemic unit economics below, club EBITDA margins are clearly high (43%).

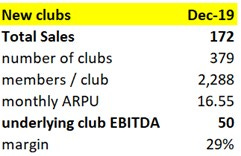

Mature clubs are more profitable than new clubs since they have more members. This makes sense as most of cost are fixed resulting in high operating leverage for BFIT. You can also see that mature clubs have a 51% club EBITDA margin vs 29% for new clubs.

BFIT employ 2.5 employees per gyms on average but they have invested to launch gyms that only employ 1 or even no employees. All the monitoring is done remotely with cameras. This could reduce salaries (17% of sales) by half, resulting in significant margin increase. This is still early days but a trend to monitor.

By gaining scale rapidly, BFIT is able to pass some of the savings to customers. For example, size is an important factor when dealing with equipment providers (Technogym and Matrix). By extracting better terms, they have been able to keep their membership price constant.

This business model is the famous “Shared Scale Economics” fly-wheel of the Nomad Partnership: “As the firm grows in size, scale savings are given back to the customer in the form of lower prices. The customer then reciprocates by purchasing more goods, which provides greater scale for the retailer who passes on the new savings as well.”

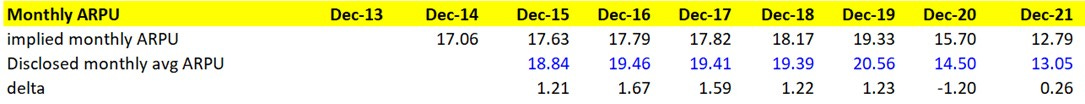

Much like budget airplanes companies, BFIT is also selling a lot of additional products, e.g., buy the €5/m supplement for unlimited sugar free vitamin water, video trainings, massage chairs, even a peloton bike competitor for €50/m (they act as a marketing agent, with no inventory or credit risk). There is also a premium membership where you pay €30 per week and you have additional perks such as bringing a guest with you, free classes, the FBIT app with workouts. The app has been very successful (thanks to covid), it is in the top 3 most downloaded fitness app in FBIT’s markets. Management has been quite vocal that their strategy is to increase ARPU through the various add-ons but not to increase prices of its 19.99€ membership. In their own word, if they start increasing prices, they will eventually become a mid-market player. 25% of customers choose the premium package, for most of the other add-ons, adoption rates are low but margins are high. Pre-covid, BFIT had managed to meaningfully increase its monthly ARPU from 19.5€ to 20.5€. During its Q1 2022 update, BFIT mentioned that 30% of signups are on the premium offer resulting in an average yield/membership of €21.5pm. Therefore, economics were not impaired by covid.

This dynamic is also why BFIT can be seen as a “Gorilla” (see Geoffrey Moore). It’s larger size vs competitors means it can invest in add-ons / technology when a smaller gym chain is simply unable to do so. In markets where it is dominant, it sets the minimum offer competitor need to provide. Indeed, if some of its technology products are successful its competitors either need to come up with an alternative or risk having a lesser product in an otherwise commoditised offering.

5. Capital Allocation

The minimal ROIC (company definition is based on EBITDA) target for BFIT to invest its capital is c. 30%. Once a club achieves a mature state, the payback period is essentially 3 years. For now, capital has mostly been allocated into new gyms but there were a few bolt-in acquisitions along the way.

Management have been good stewards of capital but they had to do capital raises during covid. First, BFIT raised 133€m in Jun-20 (at 25€/share) resulting in a dilution of c.10% which provided them certainty after they had no revenues for 3 months. Then, they raised €204m (at 34€/share) in Apr-21 also resulting in a dilution of 10%. This time the cash was needed go on the offensive and increase the rate of opening after the re-opening. For the same reason, they also issued €304m of 7-year convertible debt in Jun-21 with an interest rate of 1.5% and a conversion price of €50.6/share. I have treated the convertible as debt in my analysis and not adj. the share count for it, as the company does.

Their ability to use capital markets to raise funds is another advantage against competitors. It gave them the ability to go on the offensive at a time where private competitors were under pressure.

6. Financials:

Please see appendix for the full financials. But let me explain my key assumptions.

In line with the guidance of 200-300 store openings for to 2026, I assume that BFIT will open 250 stores per year. I also assume that mature memberships normalize to 2019 levels by Dec-2024 at 3300 members / club. BFIT is confident that they can push members / club to 3600 in the long run but I do not take that into account. I assume their newly opened clubs will have the same level of members as in 2019. I assume monthly ARPU is higher than 2019 at c. €20 for Dec-22, it was already €21.5 in Q1 2022. There could be surprise on the upside here.

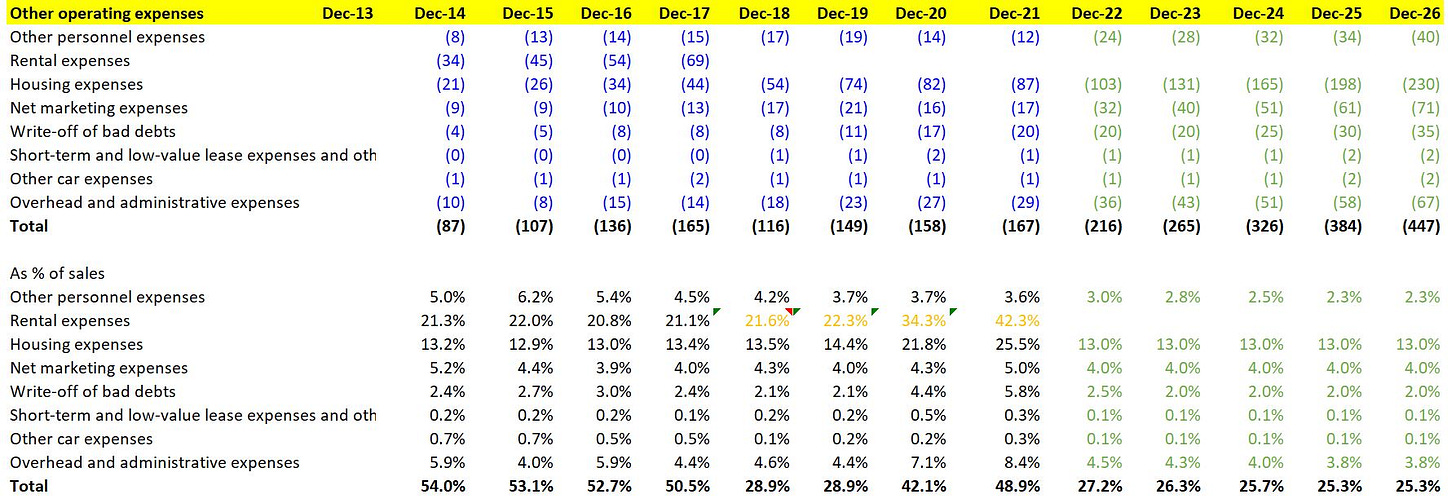

See below for the average club economics in 2024 vs 2019. Essentially, there is a slight margin improvement due to lower opex and overhead due to the larger scale of BFIT.

BFIT is without a doubt a high growth company since it should grow sales by c. 20% p.a. from 2022-26. The main growth driver is is simply new gym openings. Due to the operating leverage, EBIT and EBITDA should grow faster than sales.

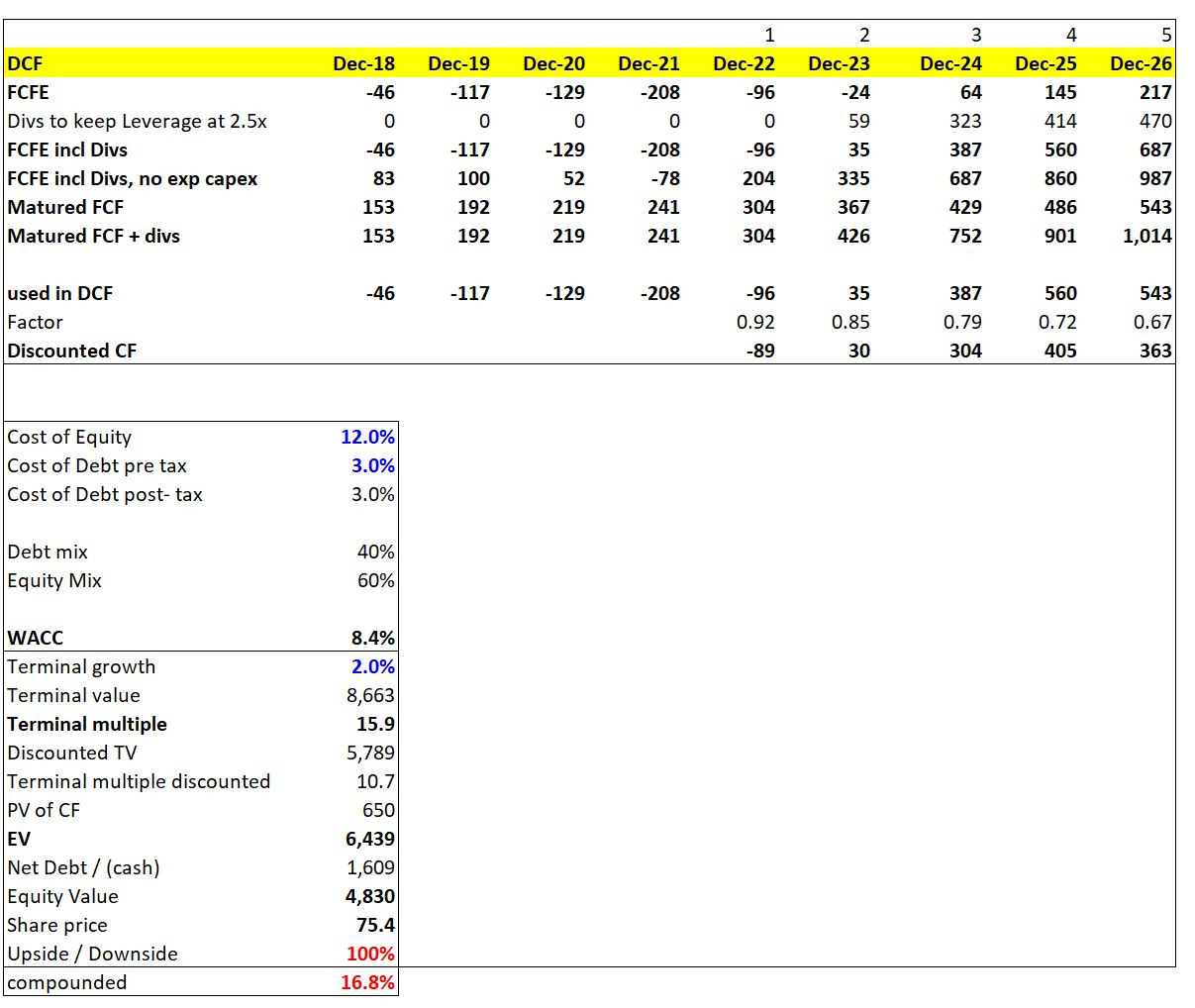

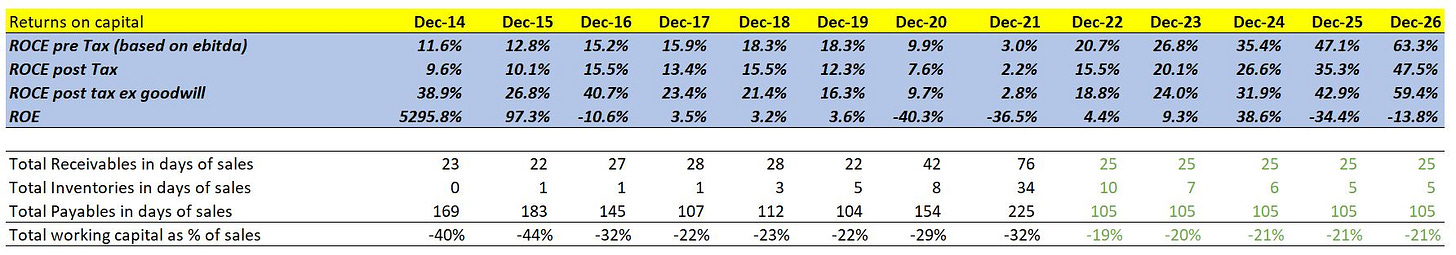

Let’s look at FCF. The company metric “Underlying EBITDA” is defined as EBITDA adj. for cash rents which are not part of opex anymore due to IFRS 16. We can then simply derive FCFE from it. They have been FCF negative as they have been re-investing everything into new gyms. Furthermore, BFIT enjoys negative working capital equal to 20% of sales, helping it partially self-fund its growth.

Historically, they have kept between leverage c. 2.5-3x, if we assume they will keep this level going forward, this will increase the cash available to shareholders. In the below, I have assumed it is sent back to shareholders as dividends but of course this will not happen. It is much more likely they will re-invest any free cash before they start paying dividends. But this will give us an idea of the cash they could generate for shareholders. I also show what is the FCFE without the expansion capex to give an idea of what will happen if they stop to grow.

Finally, I also show what happens if all the clubs reach full maturation, i.e., the FCF that BFIT will produce if all the clubs are considered to be “mature”. I use the mature club economics as a base case for this scenario. At Dec-19, mature clubs on average had €850k of sales and 51% club EBITDA margins and 14% of overhead. As this is a mature state, I assume D&A = capex and a tax rate equal to 25% as applies in the Netherlands. Mature capex is higher than previously given clubs will age at €70k vs €55k currently.

7. Valuation

Despite being a high growth company, I will use a DCF to value BFIT. For the first few years, I use FCFE including the extra cash generated to keep the leverage ratio at 2.5x. This is essentially the cash that can be returned to shareholders whilst continuing the current investment plan. For year 5, however I will use the matured FCFE without any extra cash coming from debt to reflect the steady state.

Using a terminal growth rate of 2% and a WACC of 8.4%, we are effectively implying we would pay c. 16x FCF for BFIT in a steady state which seems reasonable as at that point it will effectively be an almost infrastructure like asset. Of course, in reality, terminal growth should be higher, they will simply keep compounding by expanding in new European countries. But this is nevertheless a reasonable assumption.

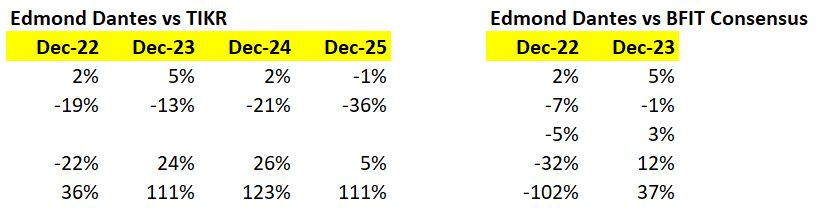

Consensus

My revenue growth is pretty similar to the consensus but EBITDA/EBIT are much different. I have not used equity research to create this report but my guess is that the analysts’ estimates from TIKR are a mix of underlying EBITDA and EBITDA. Numbers make more sense if we compare them to the consensus published on BFIT’s website.

Peers:

I have not looked at how “clean” are each of the competitor’s numbers. I simply used estimates from TIKR. IFRS 16 should have a large impact and it might not be reflected well in the estimates number. Therefore, it might be easier to look at EV/Sales, BFIT trade at a similar valuation to the Gym Group. Given the lack of overlap with its markets, it could become an interesting bolt-in acquisition at some point, although the UK market is much more competitive.

Source: TIKR

Appendix 1: Financials

Appendix 2: Other

Hi Edmond. Have been researching BFIT for a while and your write up has been key for me. Just wanted to know your opinion on the company and the thesis 1 year later of the publication. Thanks!

Good read. I am an investor in BFIT since 2019 & hoping to remain so for a long time.

I think there are a few things you should tweak;

- Energy cost will rise in H2 2023 (fixed contracts until then at low prices)

- working capital is projected to be 10 - 15% of revenue (CMD 2021 - since adoption of the 4-week system with direct debt)

But the conclusion remains the same. Even more so @ current prices!!