Bakkafrost (BAKKA), the Hidden Gem of the Faroes

BakkaFrost (BAKKA NO) ─ 2-Jun-2022

Buy BAKKA, DCF target price of 886 NOK. (43% upside)

Key Points:

BAKKA is the premium salmon producer due to its consistently higher quality meat and fish size, on average it earns a premium of c. 20% vs. spot prices. This enables higher margins and provides more margin of safety vs. its peers

Salmon supply is tightly limited by geography, water conditions, and strong regulation. Given that supply is closely tracked we can be confident there is no large source of supply incoming in the next few years

Salmon demand is healthy in developed countries and increasing in EM. Demand in the HORECA sector is recovering to pre-covid levels. China is an exciting new market

BAKKA’s recent history and future profitability is linked to the development of 500g smolts (fish not yet released in outdoor sea farms). They should reach the target this year but the 2-3 years production cycles for salmons will delay the effects on BAKKA’s financials. We should nevertheless see improvements this year

BAKKA’s Scottish acquisition is still a great opportunity for a turnaround. This can simply be achieved by transferring their know-how to the previously underinvested assets. Given the long production cycles, new procedures implemented by BAKKA are just starting to come into effect

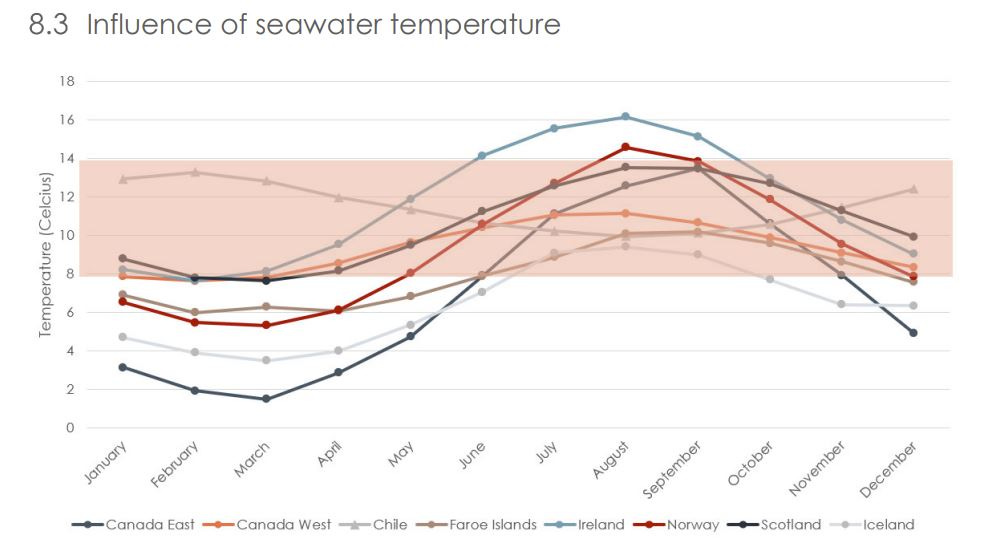

BAKKA is well placed to benefit from climate change, since the water temperatures in the Faroes will be less affected than its competitors. BAKKA should therefore benefit from a long-term edge vs. competitors

BAKKA uses more fish and less vegetal protein in its feed vs. its peer, resulting in a different cost structure for COGS. Given the recent price movements in vegetal raw mats, BAKKA should be less negatively impacted than its peers

Risks:

Execution risk. BAKKA is currently building new facilities in both of its core markets, it is possible some of the projects could be delayed. Scotland has its own sets of problems.

Salmon is a commodity despite BAKKA’s superior quality and price point. It is still a cyclical market and prices can drop fast

Investors need to be comfortable with the short-term unpredictability of fish farming. As the recent profit warnings have shown, even good operators are not immune for increased mortality

Conclusion:

At the current valuation, I would buy BAKKA as a long-term holding. Salmon prices are inherently volatile and I have spent little time trying to predict them, my DCF is based on spot prices of 6€/kg vs c. 10€/kg currently. BAKKA does not need high salmon prices for the stock to work, that is just additional upside. Furthermore, the two key factors for growth, the 500g smolt strategy and the turnaround in Scotland should both show start to bear fruit in 2022. Management is well experience and the CEO is well incentivized to execute since he owns 16% of BAKKA. I expect BAKKA to be quite volatile over the next few years but it has the right strategy, the right locations, and the right management to outperform over the long-term.

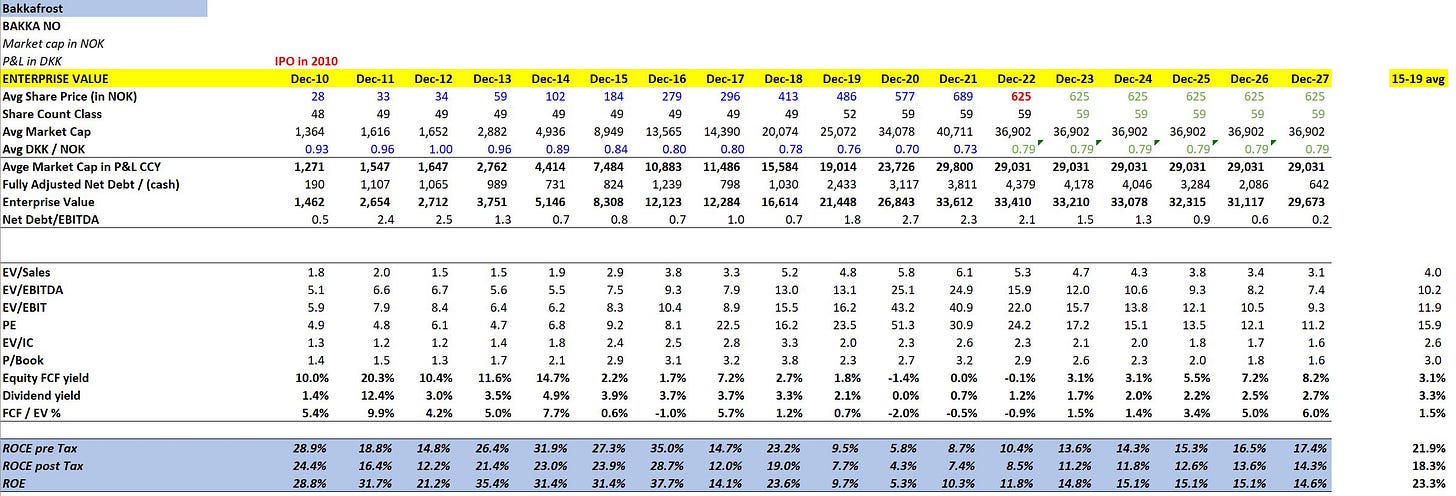

Note: BAKKA reports in DKK but is listed in NOK. DKK is pegged to the EUR at 7.46 and needs to stay within 2.25% of the peg.

Intro:

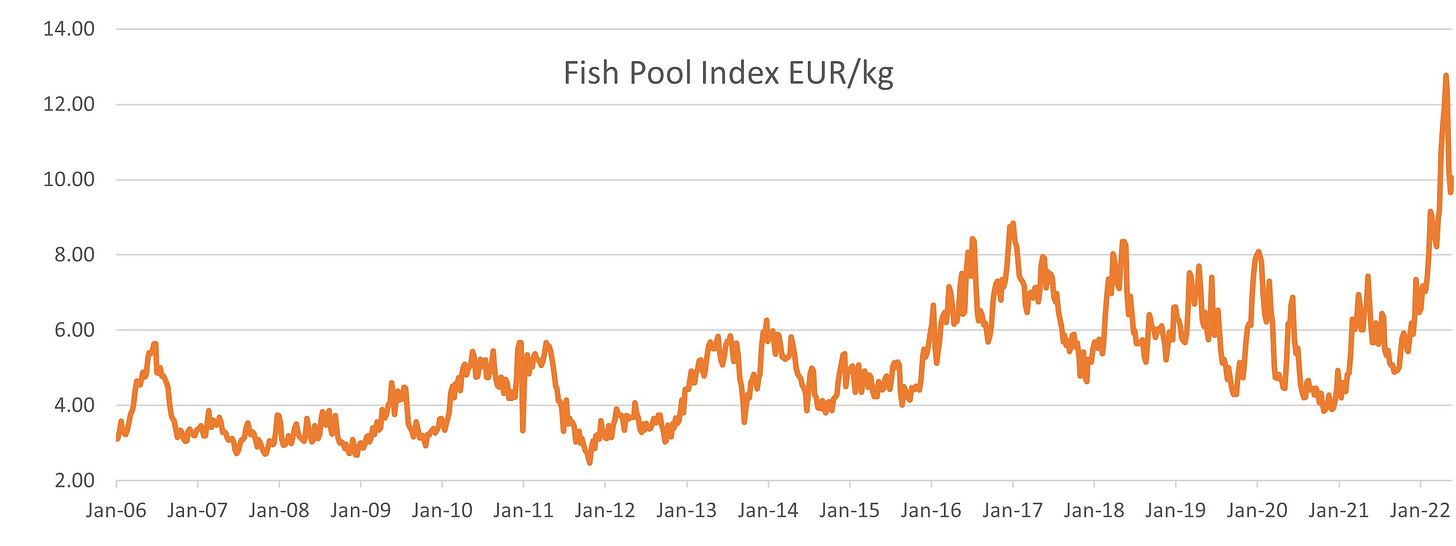

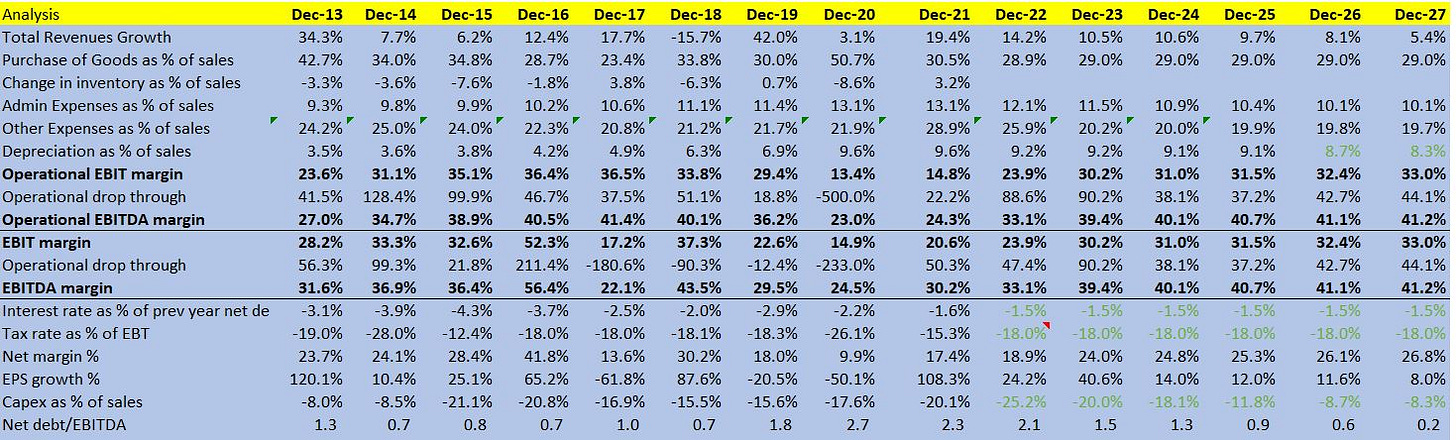

Salmon prices are inherently volatile but they have also been trending higher in the last 10 years. Resulting in high operating margins for listed salmon farmers. Note: the table below is based on “Operational EBIT” which excludes the fair value adj. of biomass due to price movements. “Biomass” is simply salmons that are not old enough to be harvested. Essentially, this is EBIT excl. MTM moves of inventories.

Current prices are near ATH due to a perfect storm: increased demand due to re-opening, lower supply than expected in the short term, high raw mats costs, etc.

Source: FishPool

The stock market has been kind to salmon farmers, over the last 10 years they have all compounded at c. 28-44% p.a., clearly, the choice of the starting point will have a major influence on best/worst performing peers but the general idea is that salmon farming has become a very profitable industry. I will focus on BAKKA in this analysis, as a believe it is the best opportunity. I will go deeper into the peers later on, there are obviously other great companies here.

BAKKA is a success story from the Faroe Islands. The firm was founded by 3 brothers in late 60s, it has now evolved into a fully integrated salmon farmer. Even today, it is a family company as the sons of 2 of the brothers are the CEO and CFO. The family of the CEO controls 15% of the company. BAKKA produces of its own eggs, creates its own feeds, controls the salmon farms on land and on sea, it can decide to sell the fresh / frozen fish as simply gutted or transformed into higher value-add products (VAP) depending on demand, BAKKA even produces its own packaging. Most of the competitors are also vertically integrated.

The core opportunity for investors comes from the relative underperformance since it acquired a Scottish company (SSC) in Oct-19. The stock performance is essentially flat since then but the company has been executing its plan. BAKKA have a “simple” task at hand, they need to build the same facilities and processes as they have in the Faroes. This will simply take time and given BAKKA’s track record, we can be confident they will able to turn the situation around.

Source: Koyfin

1. The Attractiveness of the Salmon Market: high prices, rising demand, slowly increasing supply

Salmon is sometimes referred as the “chicken of the seas” by farmers due to how relatively straightforward it is to farm it. Salmon is however priced at a premium compared to other protein:

Source: Mowi 2021 Salmon Farming Handbook

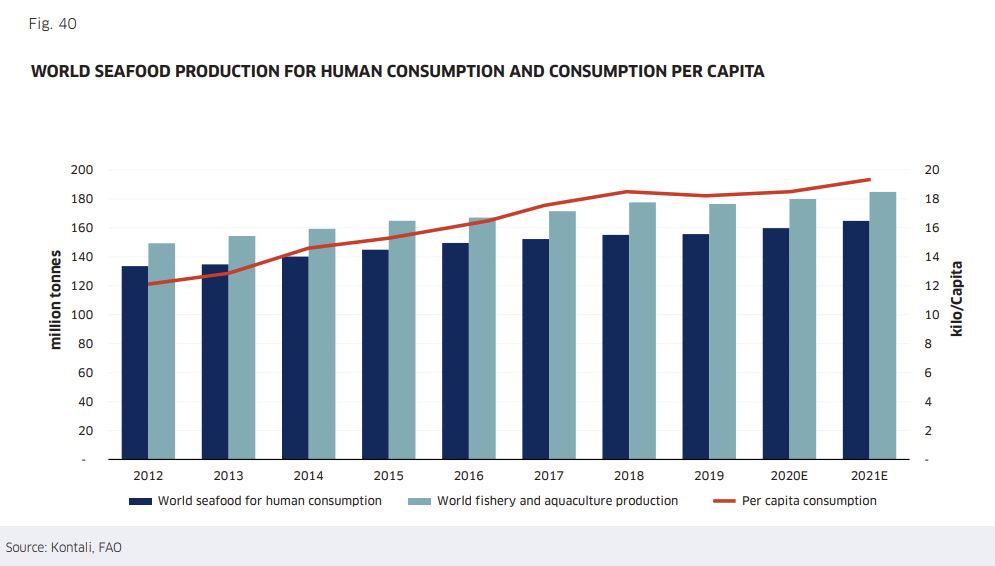

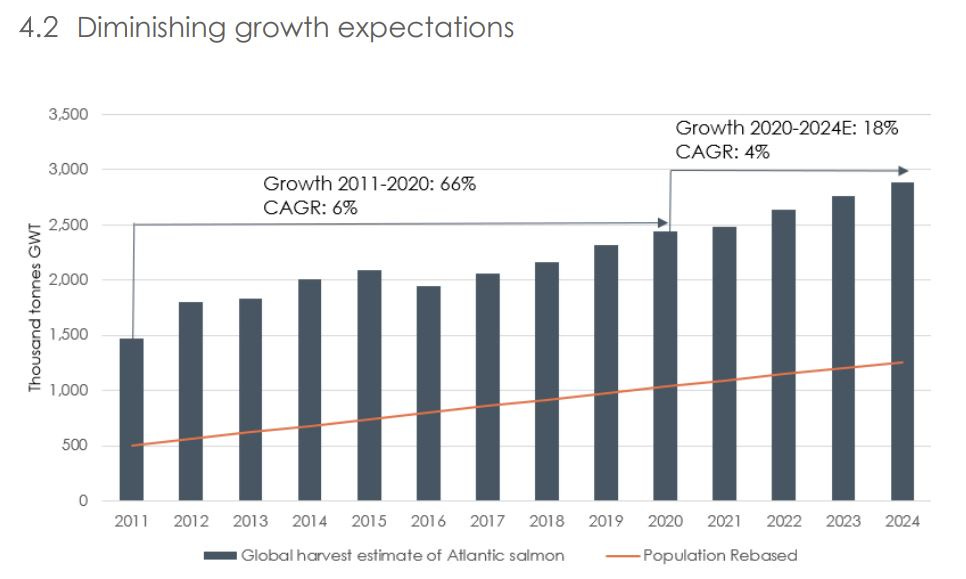

The salmon market has also been in secular growth, driven by a growing fish consumption in emerging countries and a slower growth in developed countries.

From 1961-2017, annual world fish consumption per capita has grown steadily in developing regions (from 5.2 to 19.4 kg) and in low-income food-deficit countries (from 3.4 to 9.3 kg) but is still considerably higher in developed countries (24.4 kg in 2017), although the gap is narrowing. Since 1961, fish consumption has increased at 3% p.a. vs 1.6% for population growth and 2.1% p.a. for other animal proteins (beef, milk, poultry, etc.).

Therefore, as standards of living increase so does animal proteins consumptions. Fish proteins are simply the most efficient solution to this problem. Indeed, salmon has a much lower feed conversion ratio and a high edible yield. It is therefore an efficient way to create animal proteins. This results in low water usage and low CO2/kg making salmon farming one of the greenest ways to obtain animal proteins.

Source: Mowi 2021 Salmon Farming Handbook

Farmed salmon should also benefit from new consumer trends in developed countries given that it has a better carbon footprint than meat and provides healthier proteins. According to Kantar surveys, 40% of European consumers are willing to reduce meat consumption and 60% are willing to pay more for higher quality food.

There are always ecological concerns with salmon farming but the industry knows it can only sell it at a high price point if it is considered a “premium” product of high quality. Therefore, health and quality standards are very high, e.g., antibiotics are no longer used. The industry has also adopted the sustainability trends head on since it had no other choice, e.g., BAKKA recently launched a plant to re-use biological waste into electricity and fertiliser, it is now producing 2% of the Faroe Islands energy market. Similarly, its hatching farms are usually energy self-sufficient through a combination of hydraulic / solar panels and fresh water is re-used with RAS systems to limit the impact on the environment. Peers have similar projects.

1.1 Demand in Developed Countries

Developed markets represent 80-90% of the current market for Salmon:

Growth of fish consumption per capita in the EU and US has slowed down / stagnated over the last few years but salmon consumption per capita is increasing. In Japan, consumption levels of both fish and salmon have been stable over the last 20 years.

1.2 Demand in Emerging Countries

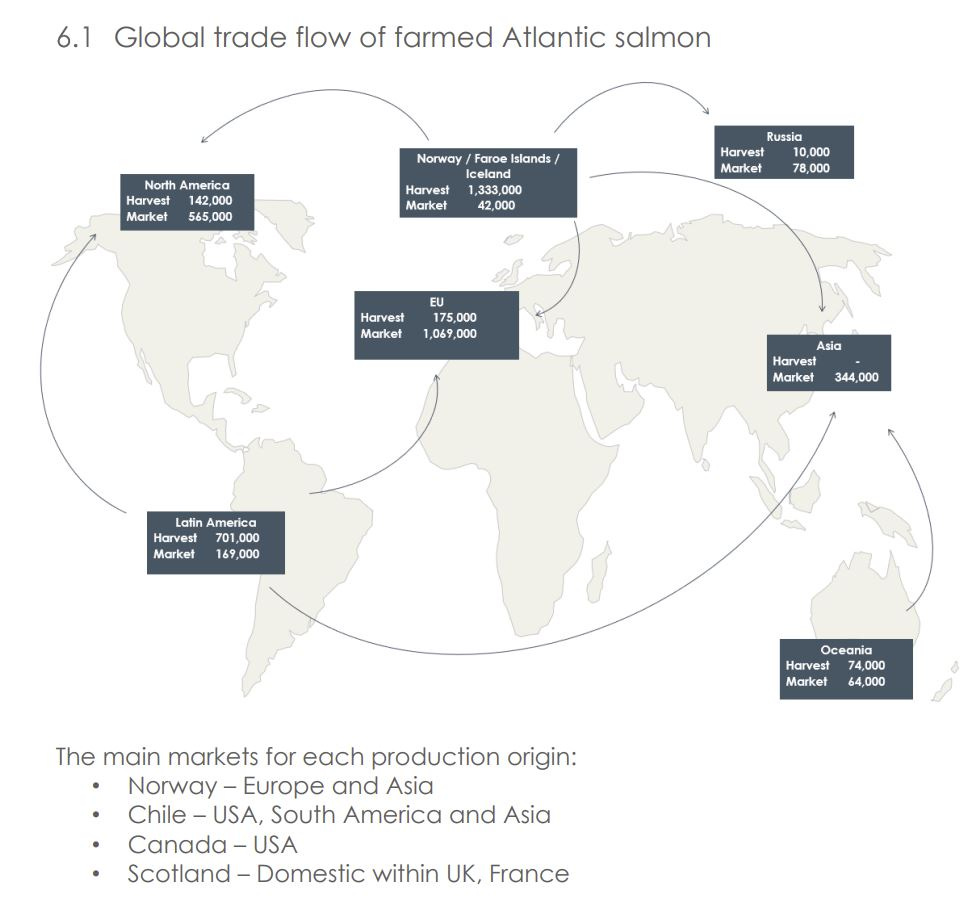

In many developing countries, fish consumption is mainly based on domestic production and therefore is stimulated more by supply than by demand. However, with rising domestic income, EM countries are increasing their imports to diversify the types of fish consumed. Salmon for instance can only be produced in specific regions for biological reasons (more on this later). Logistically, it is easier to deliver farmed than wild salmon to markets distant from where fish is caught. Fresh fish is highly perishable and so air freight is often used. Given BAKKA’s location in the Faroe Islands, air freight is the only possibility to export to non-European markets.

China was one of the fastest growing markets pre-covid. Chinese households eat fish regularly but still consume low levels of salmon. Covid broke the trend, early in the pandemic imported salmons were blamed to be a source of covid contaminations which caused panic and reduced demand. However, the Chinese government recently reduced taxes on salmon imports from 10% to 7% which should stimulate growth. Analysts predict that the market should reach 200kt by 2024 up from 124kt in 2019, the trend should still be healthy.

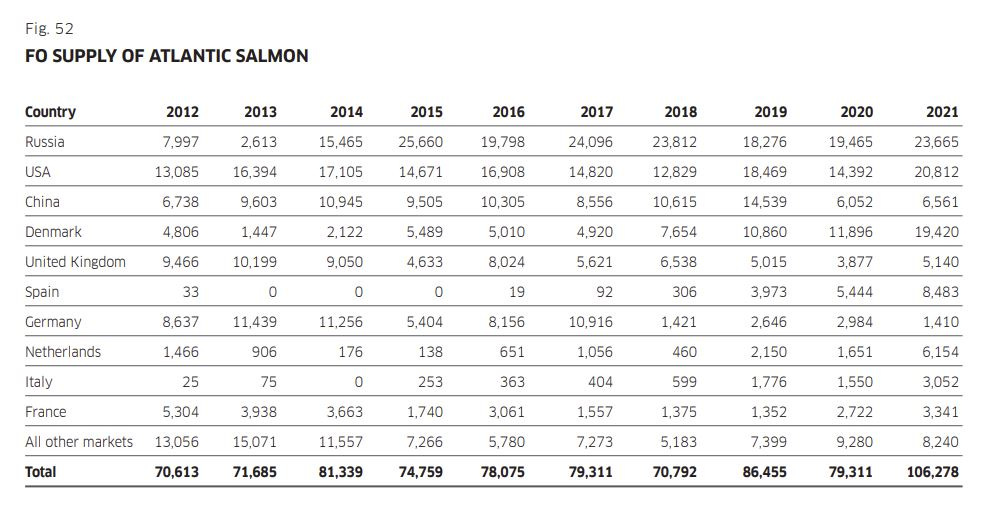

China has been an important market for BAKKA (c. 10-15% of sales). Russia has also been an important market for BAKKA as the Faroe Islands due to a technicality. Russian sanctions imposed in 2014 as a pushback after its Russian firms were sanctioned had an exemption for Faroese fish. This led to most Europeans competitors being unable to sell their fish in Russia. BAKKA stopped all sales to Russia following the invasion of Ukraine.

1.3 Farming is the Only Source of Supply

About 85% of the world salmon population is farmed, wild salmon fishing has less and less growth potential and studies show that the wild population is overfished. Given the current ESG trends, it is hard to see how it can grow meaningfully. This fits the overall trend, as the oceans are already overfished, growth can only come from aquaculture, preferably in a sustainable fashion.

1.4 High Barriers to Entry in Salmon Farming: Supply Growth is Slowing

Salmon is a commodity, there is really very little differentiation due its origin but it is worth highlighting that both of BAKKA’s locations (Scotland and the Faroes) trade at a premium. Despite being a commodity, Salmon does not follow the usual boom-bust dynamic usually associated with commodities. For example, despite prices being at ATH, supply growth is expected to slow down across the major producers.

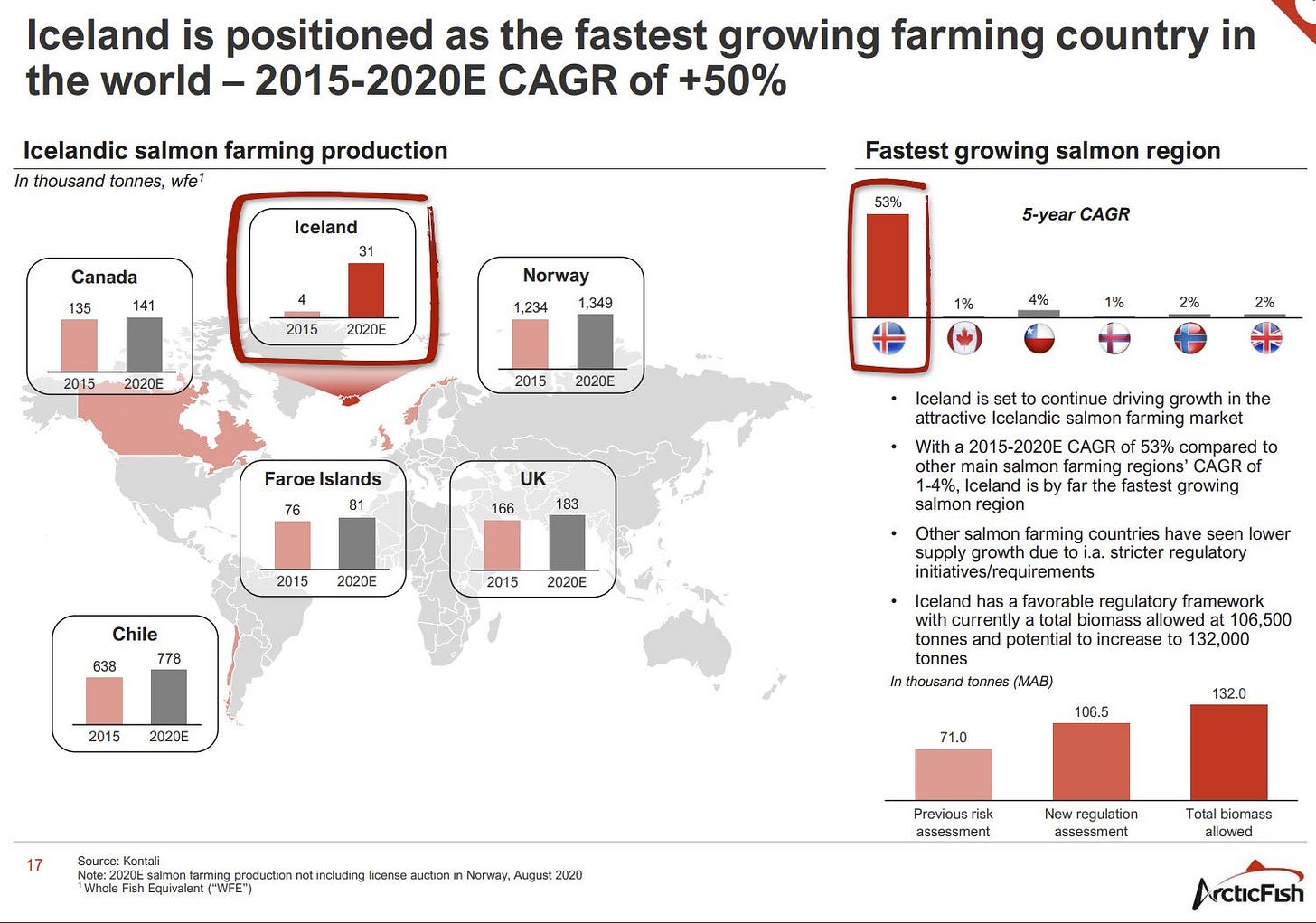

Source: Kontali; Mowi’s salmon farming industry handbook; Others include Faroe Islands, Ireland, Iceland, Russia, etc.

The main reason for the inelasticity of supply-demand is simply the numerous high barriers to entry:

a. Location & Environment

Salmon cannot be farmed everywhere. A key condition is a temperature range between above zero and 18-20oC, with an optimal temperature between 8 and 14oC. The Faroe Islands are particularly well suited for salmon fishing due to the colder waters and a smaller variance in temperature. Fish are fragile, fast changes in temperature are often deadly. Climate change is and will be a key factor in the next 10-20yrs, higher water temperatures of 1-2 Celsius is the difference between life and death for some fish farms. BAKKA is well insulated from that risk in its operation in the Faroe Islands but faces this risk in Scotland.

Salmon farming also requires a certain current to allow a flow of water through the farm. The current must however be below a certain level to allow the fish to move freely around in the sites. Such conditions are typically found in waters protected by archipelagos and fjords and rule out several coastlines. Therefore, farmed salmon is only produced in Norway, Chile, Scotland, the Faroe Islands, Ireland, Iceland, Canada, USA, Tasmania and New-Zealand.

b. Licenses

Salmon farming licenses have been adopted in all areas where salmon farming is carried out and are sold by governments. A license is provided for a specific geographic area and with a limit of production. Licenses are generally granted for many years and are renewable. Norway (50+% of total production) is extremely tightly regulated so that production rarely increases by more than 4-5%. Canada is trying to reduce the number of licenses and perhaps even move the industry on-shore. License typically include a maximum weight limit for either the fixed harvested or the fish at sea. Given BAKKA represent 80% of the Faroes production, it conveniently enjoys a much friendlier regulator, which does not include such weight limit on its licenses.

Mowi’s salmon farming handbook contains clear summaries of the license in different countries if more details are needed.

New licenses auctions are rare, acquisitions are therefore frequent across the industry and consolidation has been happening across all geographies, the top 15 firms account for 64% of the market. There is also a clear benefit from scale in Salmon farming. Furthermore, the industry is still dominated by either private family business or listed public companies with a large shareholder, often owner operated.

c. Vertical Integration

The largest players in the industry are essentially vertically integrated. This further increases barriers to entry for new players wishing to enter the industry as they would need to rebuild everything. Synergies are also a clear driver behind this integration given the healthy margins across the industry:

Source: EY

Being able to source raw materials to provide more transparency for customers is another key factor for the vertical integration. By controlling the whole process from inception to the packaging, salmon farmers can justify the premium aspect of the product, e.g., since they produce their feed, they are able to source it from “sustainable” sources and guarantee that to customers. This is the same dynamic as “organic” and normal vegetables in supermarkets.

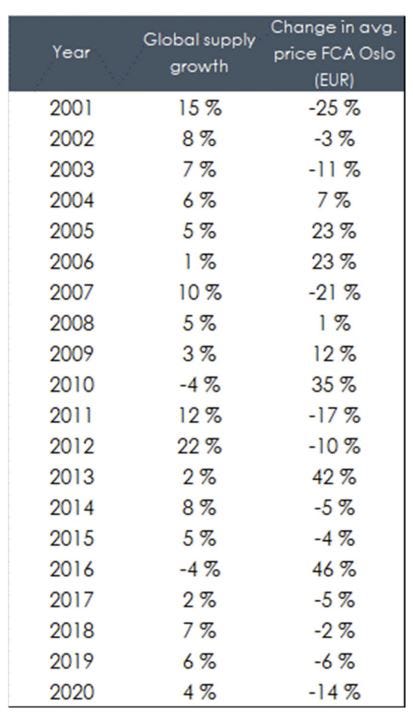

d. Prices Inelasticity

According to Mowi’s handbook, there is a strong linear correlation between global supply and change in the salmon prices. Supply has accounted for 84% of the annual price development between 2000 and 2011. Price volatility mostly comes from the inelasticity of the supply in the short term. Indeed, it takes 2-3 years for salmons to be ready to be harvested. Hatching facilities usually take 1-2 years to be created if the licenses allow it. There is simply no quick turnaround to increase production when prices rise quickly.

Furthermore, European discount retailers have recently acted as a floor salmon prices. They are known to launch and advertise large promotions when prices drop below 5€/kg which often stabilizing prices. Given it is seen as a premium product, it is easy for demand to be stimulated by low prices.

BAKKA (and its peers) is trying to mitigate its exposure to spot prices by entering into bilateral fixed price/volume contracts with its customers. The contract share has historically varied between 20% and 50% of sold volumes, and the duration of the contracts has typically been six to twelve months. In 2021, BAKKA’s overall contract share was 33% vs 47% in 2020. When the lucrative HORECA channel closed due to covid in 2020, they managed to simply shift production to VAP (value-add products) as customers were eating Salmon at home and not outside. They even launched a DTC brand in the US, with short deliveries to take advantage of this trend.

Vaccine sales, smolt releases and feed sales are good long-term harvest indicators, as it takes up to 2 years before the fish is harvested after vaccination and smolt release. A warmer winter usually correlates with larger harvest quantities for the following year.

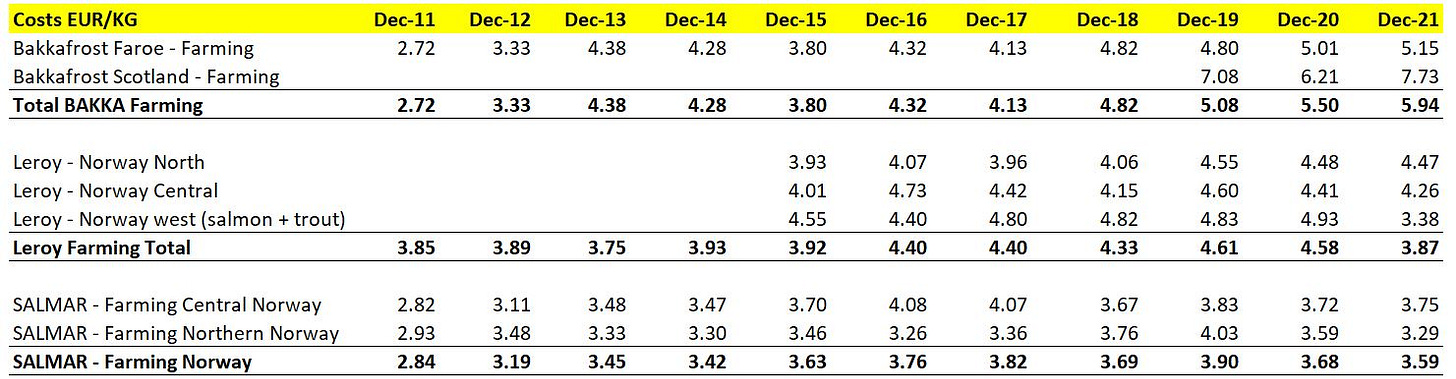

According to market research consultants Kontali (used by the whole market), the average Norwegian fish farm is breakeven at c. 4€/kg vs 4-5€/kg for BAKKA. Due to the high investments into new hatcheries to increase smolts to 500g BAKKA’s cost/kg has increased but benefits are not yet shown. To sense check this, we can compare it to disclosures from the listed peers. Note: I have only included Leroy and Salmar as other peers do not explicitly separate farming and added value EBIT by region.

Source: Kontali

e. Mortality is Common in Fish Farming:

The monthly survival rate for salmon in a sea farm is c. 99% per month. Given salmons spend 15-20m at sea, the average mortality rate for smolts is c. 15-20%. There are many different reasons behind the losses but temperature is in all cases the biggest driver as most other problems are by-products of warmer water. That is why geography is such an important part.

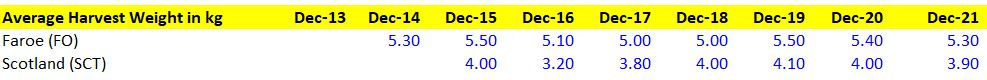

Sea lice are the largest problems facing the industry, on average the infection rate is 0.45/ salmon for BAKKA. And they are supposedly “less affected” by the problem… There are several methods to try to get rid of sea lice: chemicals, mechanic, cleaner fish, freshwater treatment. Without going into details, it essentially raises costs, e.g., BAKKA is using ships to treat salmons with freshwater obtained by reverse osmosis. This is not particularly energy efficient, but they have no choice. Early treatment of gills is an important factor for the survival rate. Sometimes an early harvest is the most cost-effective action despite the smaller fish size and therefore lower price/kg. This is what happened to BAKKA in Q4 2021 in the Faroes leading to lower average harvested weight.

Algae and jellyfish can stick to fishes’ gills and suffocate them. Wild fish can swim away from algae, but farmed fish are trapped. Warm weather is the key catalyst for apparition of both.

Infectious salmon anaemia (ISA) is a disease due to sea lice with potentially dramatic consequences. In 2007, Chile ordered to kill all young salmons so the disease would stop spreading. As a result, Atlantic salmon production in Chile was divided by four between 2006 and 2010 from 400kt to 100kt. This is usually not a problem for BAKKA since ISA was not present in the Faroe Islands from 2003-2017.

Warm water reduces levels of oxygen which stresses salmons and eventually kills them. Sharp change of temperature due to large rainfall can also lead to deaths.

There is simply no lack of external factors that might kill salmons. But the bottom line is that so far salmon farmers have well managed the risks overall and despite the higher costs it has not been too detrimental to the overall profitability.

2. BAKKA’s differentiation and strategy

2.1 Overview

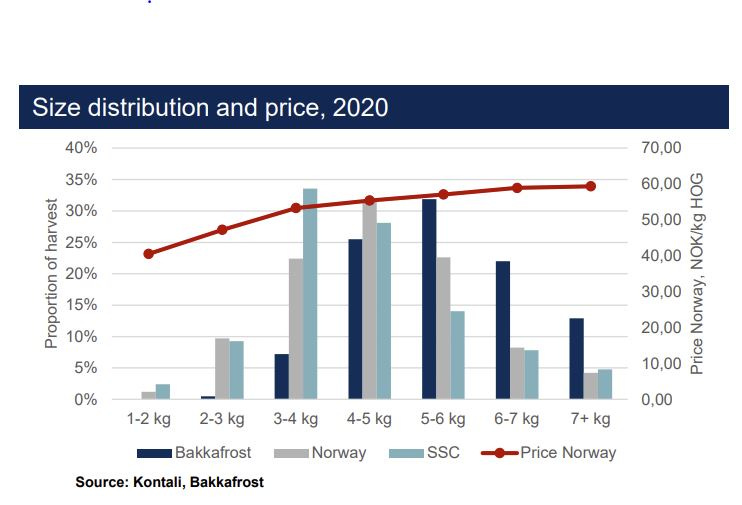

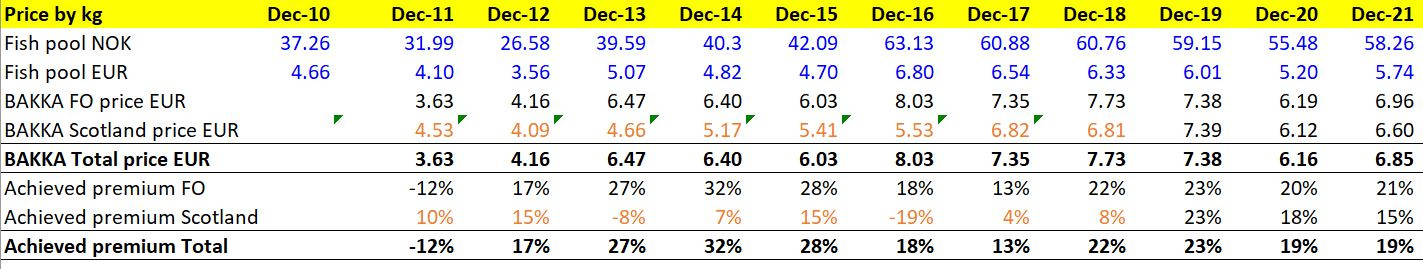

BAKKA’s core strategy relies on achieving higher fish sizes to obtain a price premium for its salmon. As shown below, its proportion of harvest larger than 6kg is c. 35% vs c. 10% for competitors in Norway.

Another differentiating factor is that BAKKA internal feed contains much higher marine animal protein (50% fish / 50% vegetal) than the ones used in Norway (20% fish / 80% vegetal). This was designed to ensure high levels of omega 3 and other healthy nutriments resulting in higher quality fish meat but also in higher raw materials costs. There are currently tests to create plant-based feeds to obtain similar levels of omega 3 but to no success so far. Vegetal commodities prices have increased substantially in 2022. Due to its lower vegetal content BAKKA could be less affected than its peers.

Additionally, Scottish salmon carries a price premium due to its superior branding despite smaller catch sizes. The bull case is that BAKKA is able to gather a premium for size as well by improving the operations.

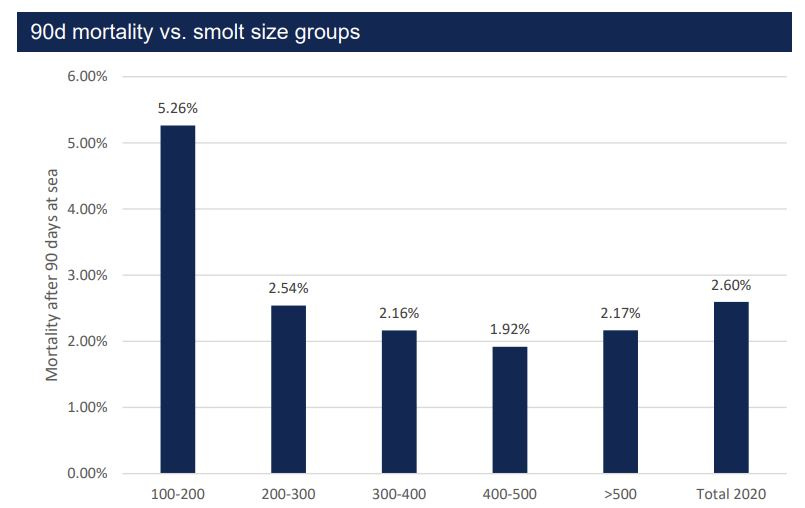

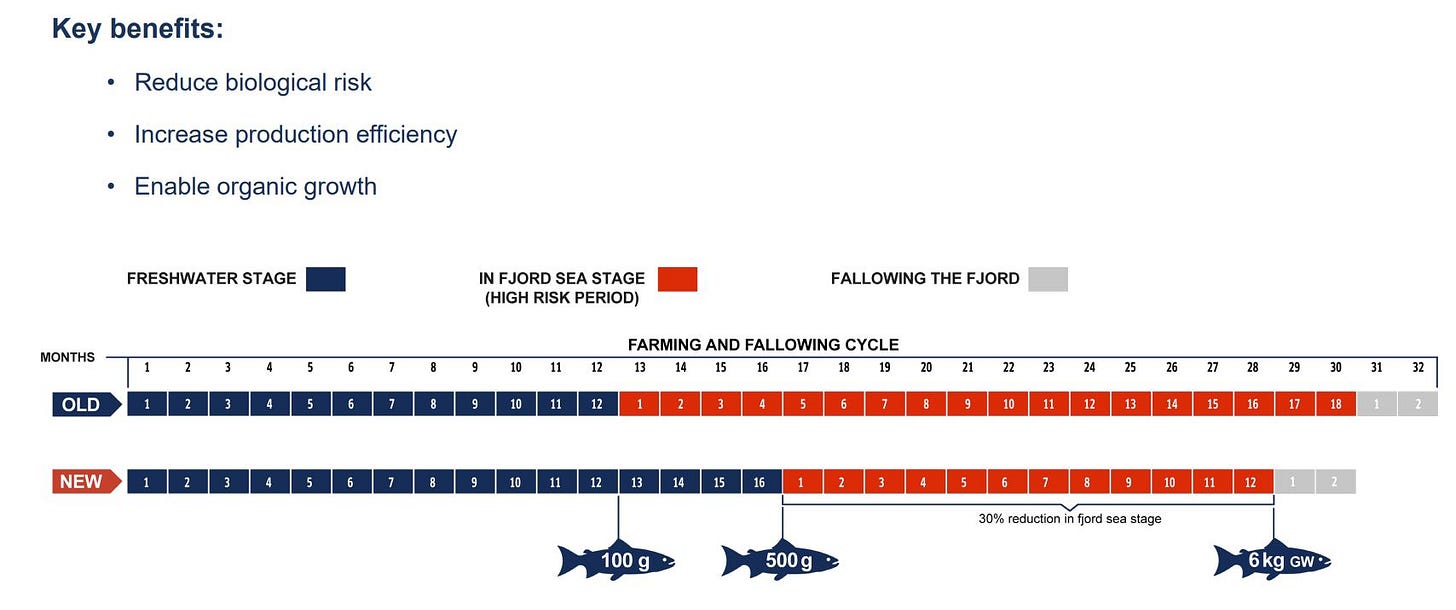

In 2015, BAKKA announced its strategy for fish farming going forward. Essentially, BAKKA’s aims to increase the size of the smolts from 100g to 500g and this would essentially reduce mortality. Smaller fish are simply much more fragile to the environmental stress found in the fjord farming vs in-land, it makes a lot of sense. In its Sep-21 investor day, BAKKA released data on the 90d mortality of smolts vs size groups and over time. The data is clear that larger smolts have lower mortality vs 100g smolts. 90d mortality has essentially been halved from c. 6% to 3%. From 2017-19, had a few problems whilst upgrading their facilities and smolt weigh stagnated. The latest smolts release were c. 380g and BAKKA target for 2022 is c. 500g, so the problems are resolved. The current generation harvest in the Faroe were c. 250g smolts.

The other key benefit of is that the salmon will spend only 12m at sea vs 18m currently and reducing the overall farming time by 2m. The competitive advantage gained is due to the nature of the Faroese licenses. Since there is no maximal harvest weight to the license contrary to Norway and most other countries, BAKKA are free to increase their harvest per license. That explains why most of the other salmon farmers have not pushed for such strategy (except GSF). Importantly, the shorter time at sea reduces the exposures to pathogens, sea lice, etc. which will also improve yields and reduce costs.

BAKKA has been able to develop this strategy in part due to the friendly regulatory environment of the Faroes, where it accounts for 70%+ of the production. The market is also concentrated with just 2 other players (Luna and Mowi). Companies have co-operated and swapped licenses to have large uninterrupted domains and avoid situations as in Norway where Fjords might need to be shared by a few license holders which can cause all sorts of issues.

If successful, there is no doubt that this strategy will eventually be copied by competitors if regulations allow it. But BAKKA has had a few hiccups along the way despite the simple concept. It has essentially pushed back the target for smolts at 500g from 2020 to 2022. GSF is the other large farmer following the large smolt strategy. Whilst Salmar and Mowi have decided to bet on offshore farming due to the limits on biomass per license in Norway, BAKKA has applied for off-shore licenses in the Faroes but does not plan to invest for now.

BAKKA had to re-develop its existing hatcheries to be able to farm the much larger smolts and also increase production by construction new hatcheries. The plan is to increase production to 23m smolts in the Faroe by 2026. If we assume the avg catch stays at 5.5kg and that mortality is c. 15% (avg. 2014-2021) this would result in 107kt of Salmon farmed, comfortably ahead of its target of 100kt by 2026.

BAKKA will not be able to gain any more licenses in the Faroes since no company can hold more than 50% of licenses per law. Its market share is much greater than that in any case. Local competition is diminished as the law states that non-Faroese investors cannot hold more than 20% of a salmon farming company, Mowi is exempt given it acquired its facilities before the law was passed. This also serves to protect BAKKA’s independence from a takeover.

2.2 The Scottish Acquisition / Headache

Given the lack of reinvestment opportunities in the Faroes, BAKKA had no choice but to expand abroad. It was not surprising that they acquired SSC in Oct-2019 for 4.3bn DKK at 7.2x EV/ EBITDA which it paid by issuing new shares (eq. to 20% of its mkt cap). BAKKA traded at c. 15-16x EV/ EBITDA when the deal was announced. I believe it was a smart strategic choice given SSC accounts for 20-30% of Scotland’s salmon production. Scottish salmon is also sold at a premium so it makes sense to combine it with BAKKA’s premium offering.

This is a turnaround story but in reality, it is just a know-how transfer. Salmon farming is a mix of processes, technological knowhow and discipline / monitoring. There is no particularly reason why BAKKA will fail to turn the facility around. The only thing needed is time. Indeed, it has become apparent that SSC was simply not properly run. The company was put together by finance people rather than by industry insiders, both the previous chairman and CEO came from a PE/VC background and it shows since BAKKA is essentially rebuilding the business from scratch:

SSC had 9 hatcheries, BAKKA is closing down 8 and is essentially rebuilding the whole facility (or almost) to satisfy the needs of its large smolt strategy. They are in the process of finding space for 2 new hatcheries

Some feed and smolts were externally sourced, the contracts have now all run down and BAKKA will internally source them going forward. Some of the salmons currently harvested were released as 50g smolts vs the current 380g for the Faroes.

3 new delousing boats have been acquired and will be operational to help alleviate sea lice problems in the summer/ autumn. SSC did not use similar boats in the past.

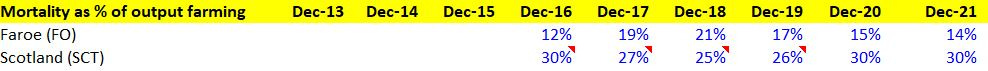

The Scottish farms have high mortality. The real issue here is that Scottish waters are warmer and therefore more problematic with biological hazards. The Scottish mortality rate is almost 2x larger than the one in the Faroes. BAKKA was somewhat unlucky since it got hit in the last 2 years by problems previously less present.

If we look at the cost/kg we can see that Scotland is almost 2.5€/kg more expensive than Faroese operations. Economics should be mitigated once BAKKA improves volumes and the average catch size. LSG and Salmar have had no problems running a profitable JV in Scotland, it recently bought the underperforming Scottish assets of GSF.

The acquisition is clearly unsuccessful so far but given the long production cycles for salmon farming, they are still currently harvesting salmons that were released by the previous owners. The reality is that it will simply take time for the BAKKA to turn around, there is no magic solution.

After 2 years, I think they are at an inflection point since the main fishery will provide smolts at 250g and the arrival of delousing boats should help limit mortality to more sustainable levels.

2.3 Capital Allocation Strategy

Furthermore, the Scottish acquisition has diluted ROCE (due to higher intangibles) from the historic levels of c.20% to HSD.

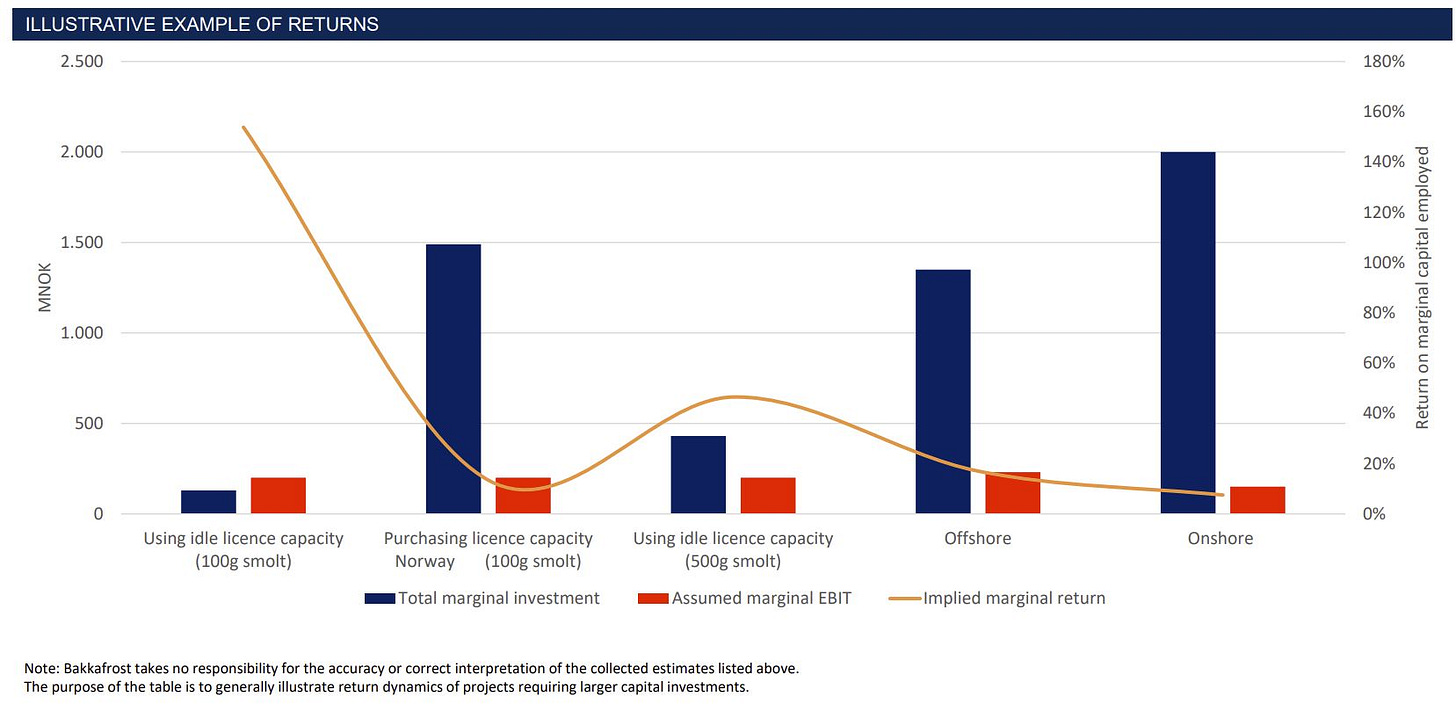

In the Sep-21 presentation, BAKKA showed why they have been mainly investing in 500g smolts. They simply believe it provides them with the best ROCE at c. 50%, a 2 years payback period essentially. This should mean that once the fisheries achieve 500g smolts, we should see incremental returns increase. Smolts are supposed to reach 500g this year in the Faroes so it should be a turning point, although those smolts will be harvested in 3 years. Shorter production cycles should also improve returns simply by increasing the inventory turn.

Much has been written about offshore and onshore salmon farming. Offshore farming is an interesting possibility, clearly a lot of the environmental problems could be solved by it. But it is also clear that the technology is far from being ready and that the current projects are early R&D prototypes. It will take time to develop the technology but there is no rush for BAKKA to invest in it for now. It can let larger competitors try to solve the problem and invest later on. There is no first mover advantage, especially if other investments have a more attractive risk-reward.

Onshore farming on the other hand is currently what I would call an ESG dream. I think it probably belongs in the same category as overhyped ESG technologies such as EVs or hydrogen producers. The idea sounds nice on paper but I suspect it will be a nightmare. BAKKA’s strategy is based on using onshore farming for smolts up to 500g and they had a fair share of issues. But farming 500g smolts and 5kg salmons is not the same thing. The energy requirements to keep the water flowing at the right temperature and right oxygenation alone will be massive. Pathogens will still be problematic despite the best filtering technology, nature usually finds a way. I think the BAKKA slides capture the idea, the upfront investment needed is large and most problems will appear a few years after the investment with little ability to forecast them. The business will in any case be quite vulnerable to energy markets variations. At current energy prices in Europe, it also probably does not make any sense. EY forecasts that by 2040 land-based salmon will be 25% of a 6mt market for salmon vs 3mt currently. Expectations are clearly sky-high.

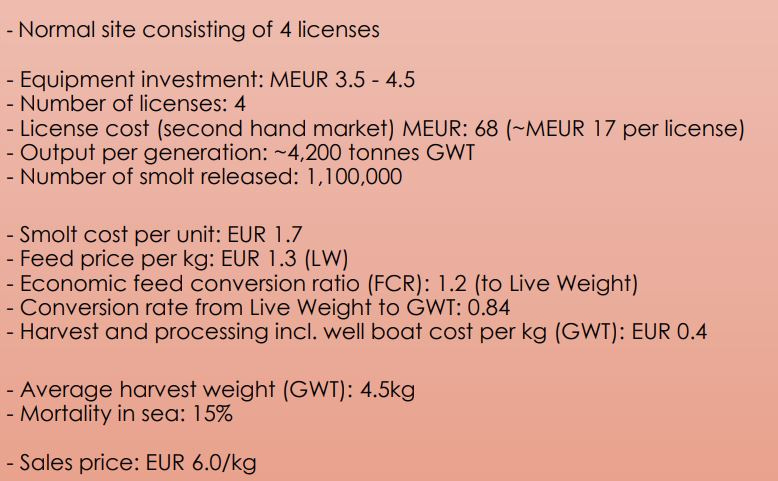

Mowi also provides us with maths on the usual acquisition targets. The below implies a return of 18% p.a. or a payback period of 5.6years. Which is similar to BAKKA’s ROCE pre-2019. We can therefore understand why some of the large competitors have preferred to focus on bolt-in acquisitions rather than investments in 500g fisheries. For now, it still makes senses to roll-up licenses.

3. Peers overview

BAKKA has always managed to sell its salmon at a higher price than the average of its listed peers, c. 15-30% over the last 10yrs. See below for the split of Op. EBIT / kilo. One thing to worth remembering is that not all companies report a farming / Value-add segment. So, you need to adj. BAKKA’s numbers to compare them with MOWI, etc.

Further consolidation is happening, since Salmar is currently in the process of acquiring NRS in order to become the 2nd largest salmon farmer.

Iceland is a promising market for Salmon. It shares much of the same characteristic as BAKKA in terms of water quality, temperatures, etc. 3 Icelandic companies have IPO’d over the last few years and they have started to be profitable. It is still early days but a market to watch, most of them are spin-off from the other large players. I will mostly likely spend some time on it in the next few months.

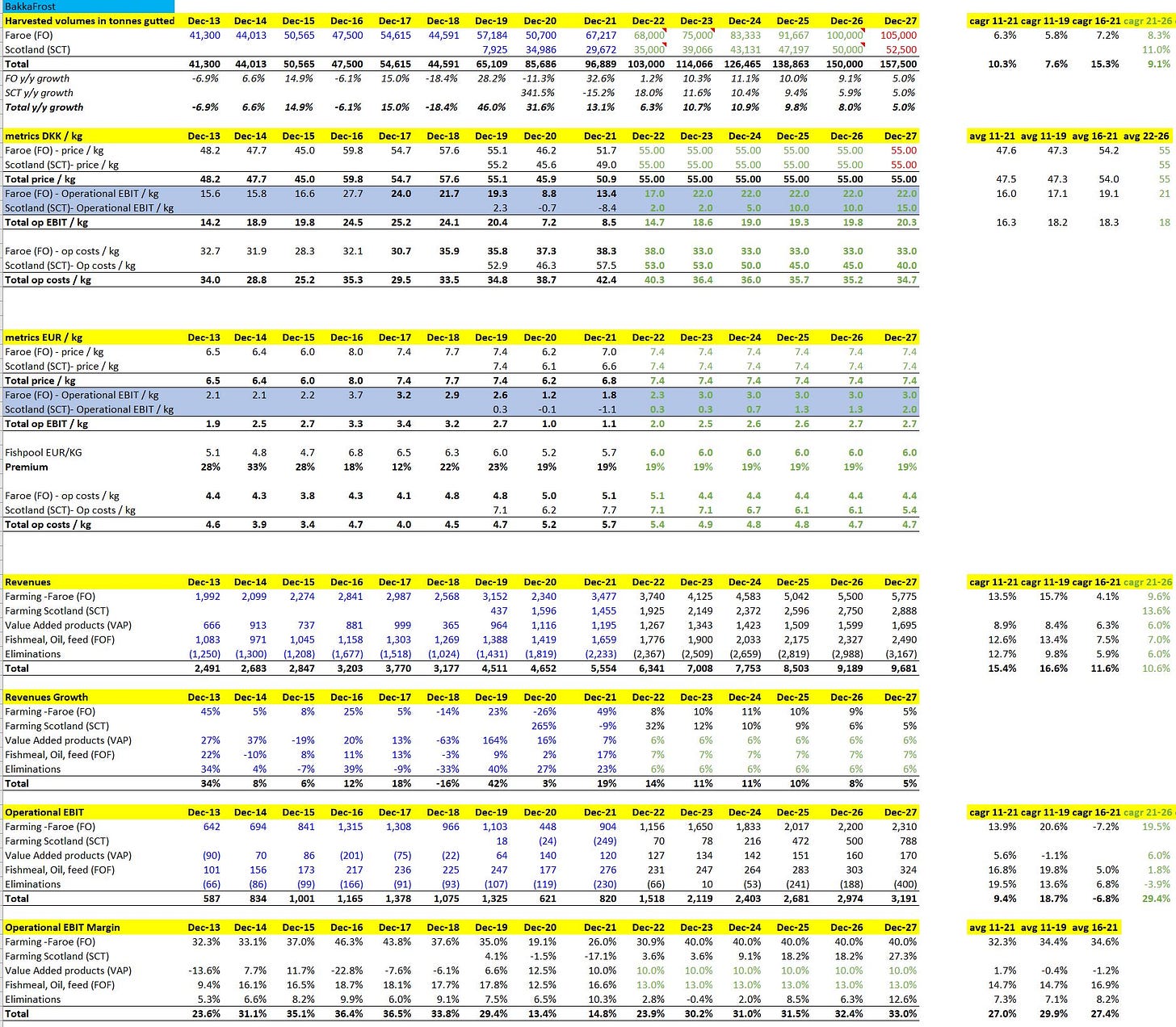

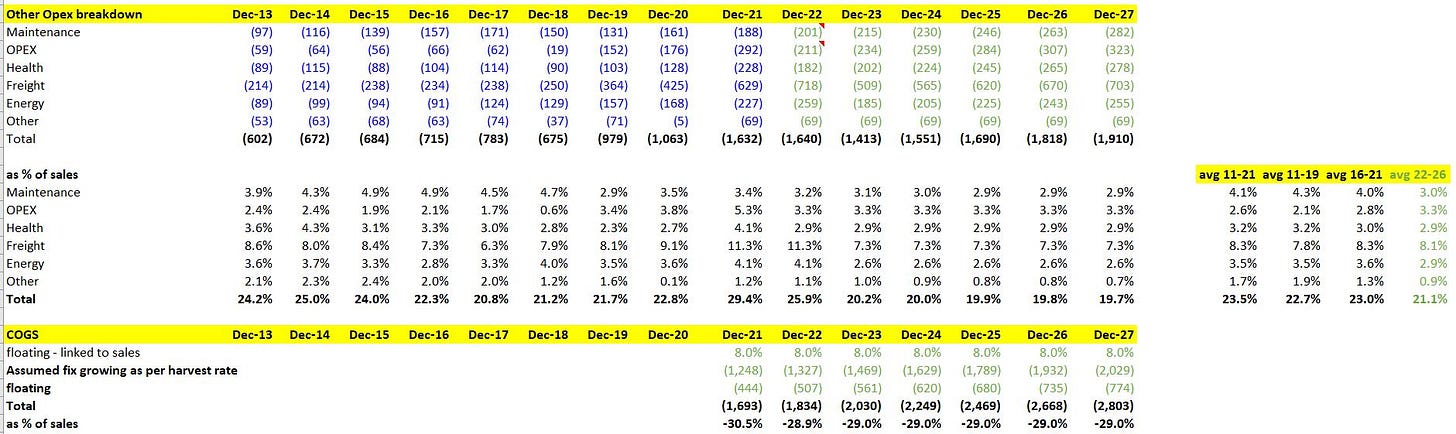

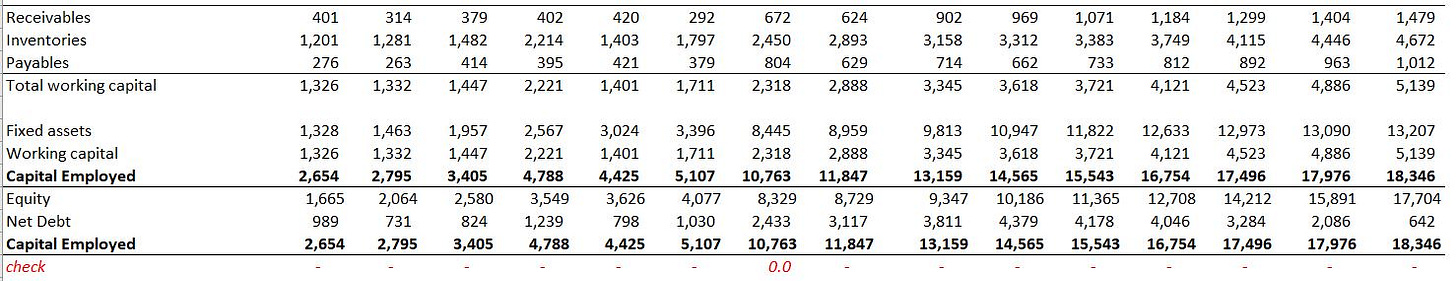

4. Financials (see appendix for the full financials)

Modelling BAKKA essentially comes down to price*quantity. I do not differ from the guidance for the harvest. For the price, see below, I am basing my model on the average price over the last 5 years, i.e., 7.3€/kg. Assuming that BAKKA achieves a premium of 19% over Fishpool prices, it would imply that the benchmark is c. 6€/kg. Current spot prices for Fishpool is c. 10€/kg but I assume they will revert to historical levels. Clearly is they stay at current prices, BAKKA is even more interesting.

5. Valuation

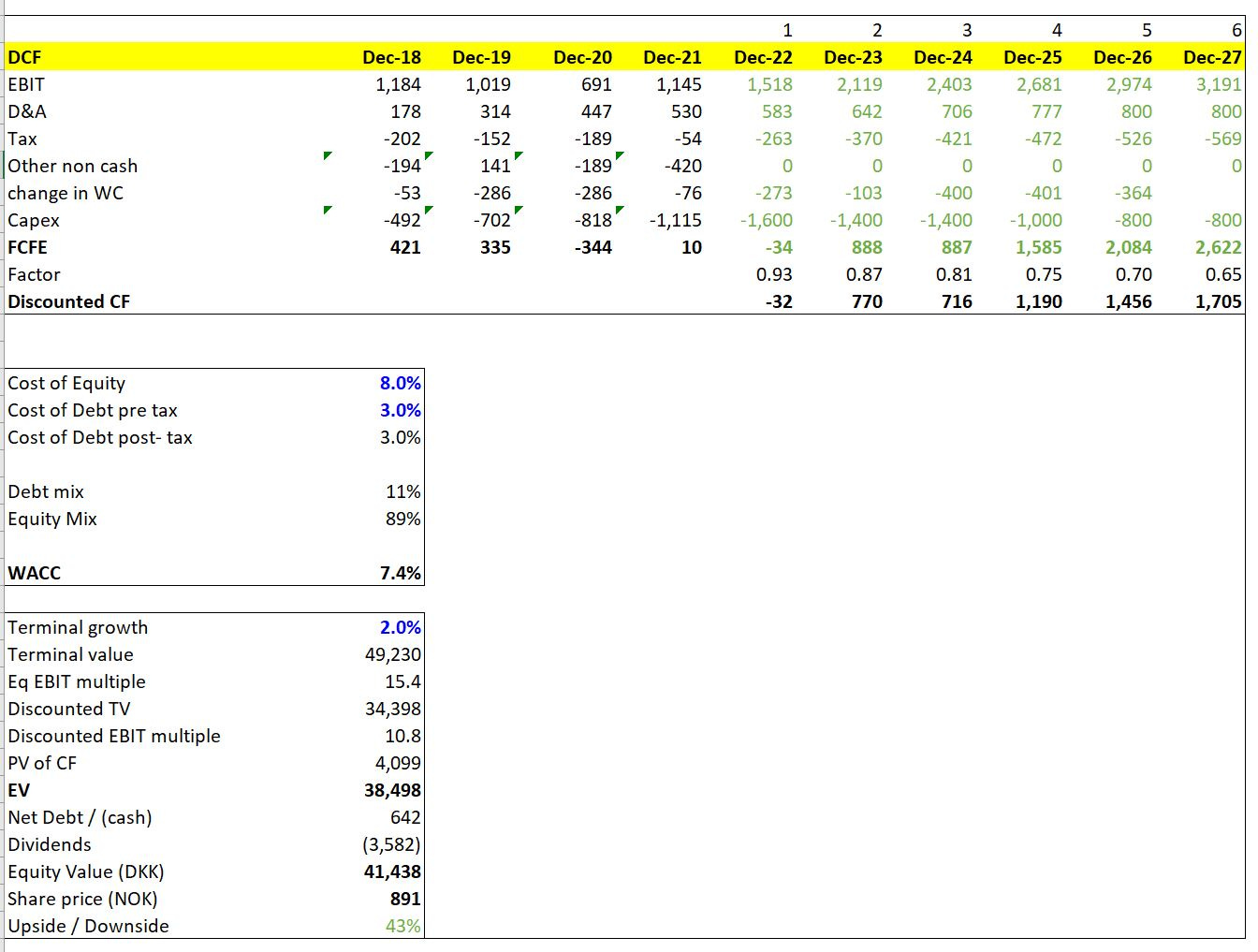

Assuming BAKKA sells its salmon at 7.4€/kg, i.e., Fishpool is at 6.0€/kg we have the following valuation:

If we update the prices to be close to current Fishpool spot prices of 10€/kg, BAKKA is clearly much cheaper:

Looking at the DCF, the base case translates into 43% upside:

I have shown some sensitivity analysis below. Note that the sensitivities are based on prices for BAKKA, the equivalent for Fishpool is shown below.

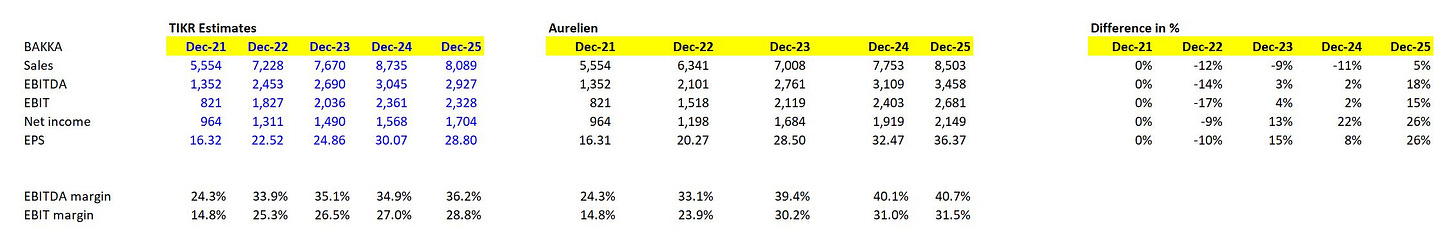

I have assumed lower salmon prices but higher margins compared to consensus estimates (based on TIKR) resulting in lower sales but comparable EBIT.

6. Peers Valuation and Estimates

BAKKA is trades at a premium vs its peers, being the premium player. Note that 2025 estimates are quite unreliable given the volatility of salmon prices.

Source: TIKR

Appendix:

We can also look at the sensitivity table for the WACC:

Solid analysis

Liked your analysis, Great work 👍, keep up